Five Cognitive Biases Sabotaging Your Decision Making

10 min read Discover five cognitive biases that undermine your decisions and learn how to overcome them for clearer, smarter choices. (0 Reviews)

Five Cognitive Biases Sabotaging Your Decision Making

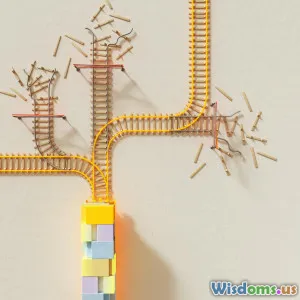

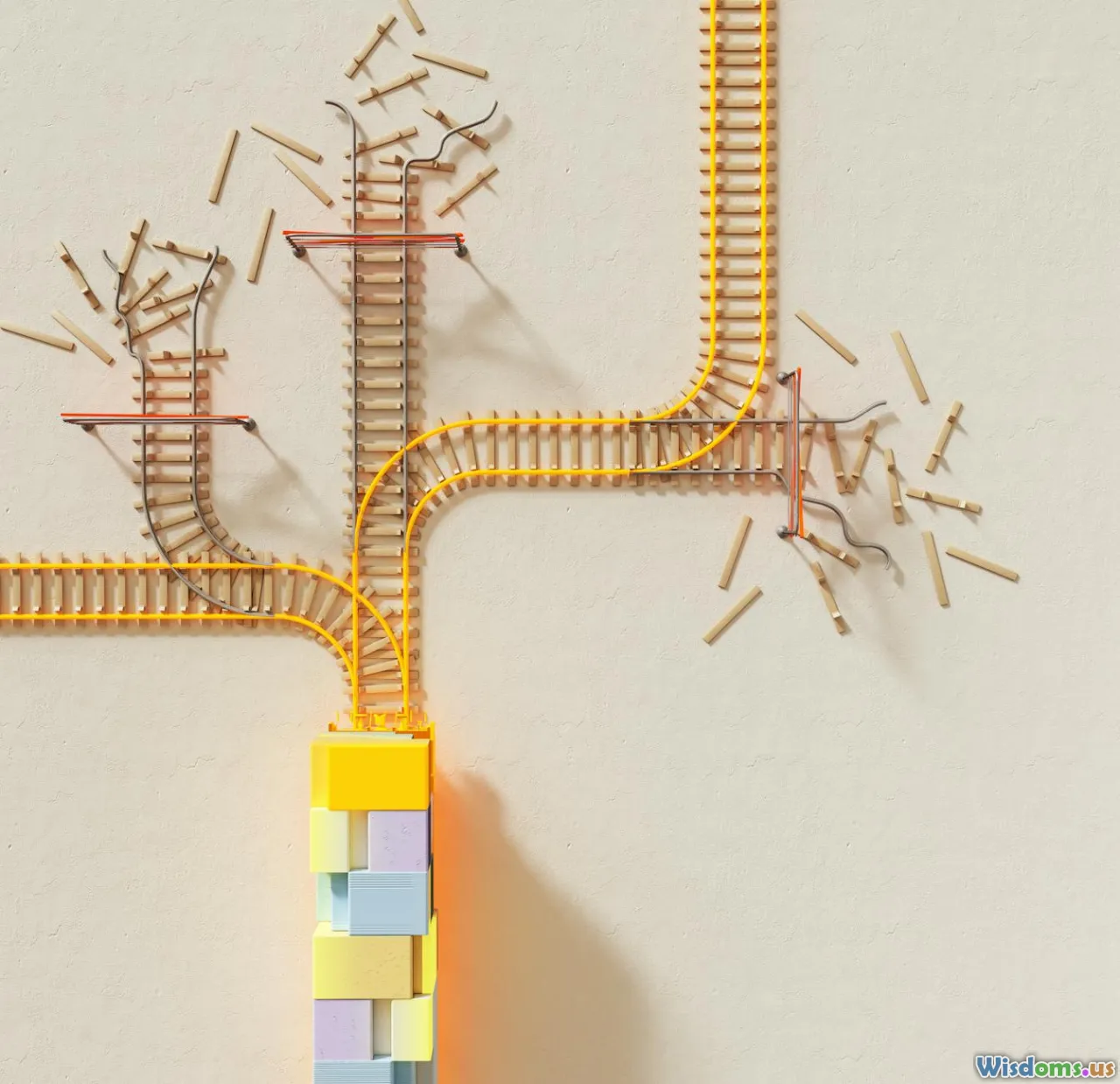

Every day, we’re faced with a barrage of choices—from trivial to life-changing. Yet, our ability to make sound decisions is often hindered by unseen forces within our own minds: cognitive biases. These mental shortcuts evolved to help us navigate complex environments, but paradoxically, they often lead us astray, resulting in poor judgment and missed opportunities. Understanding these biases is crucial if you want to make smarter, more rational decisions—whether in your personal life, career, or relationships.

In this deep dive, we’ll explore five cognitive biases that frequently sabotage decision making, backed by research and real-world examples. Along the way, you’ll learn how to recognize and counteract these biases, empowering you to regain control over your choices.

1. Confirmation Bias: The Echo Chamber of Your Mind

What is it? Confirmation bias is our tendency to seek, interpret, and remember information that confirms our preexisting beliefs while ignoring or undervaluing contradictory evidence.

Why it matters: This bias traps us in a feedback loop that reinforces our views, often blinding us to alternative perspectives or facts. For example, a person firmly believing in a particular political ideology may focus only on news outlets that reinforce their stance, dismissing opposing viewpoints as untrustworthy.

Research Insights: In a classic 2013 study published in "Science," researchers found that when individuals encountered mixed evidence on climate change, they tended to embrace information aligned with their political orientations, ignoring contradictory data. This phenomenon makes civil discourse and collective action more difficult.

Real-world Example: Investors driven by confirmation bias may hold onto failing stocks because every piece of news ‘confirming’ their initial optimism seems more credible, ultimately resulting in larger losses.

How to counteract it:

- Seek disconfirming evidence: Actively question your assumptions by searching for information that challenges them.

- Play devil's advocate: Engage with people who hold differing views or simulate opposing arguments yourself.

- Reflect mindfully: Before finalizing major decisions, pause and evaluate whether you’re favoring familiar evidence.

2. Anchoring Bias: When the First Number Haunts You

What is it? Anchoring bias occurs when we rely too heavily on the first piece of information—an anchor—when making decisions, even if it’s irrelevant or arbitrary.

Why it matters: This bias shapes negotiations, pricing, and evaluations, often skewing outcomes.

Research Insights: Psychologist Daniel Kahneman illustrated anchoring in a 1974 experiment where participants guessing the percentage of African countries in the UN were influenced significantly by a random wheel spin that produced numbers unrelated to the question. Those exposed to a high random anchor guessed higher percentages than those given a low anchor.

Real-world Example: In salary negotiations, the initial offer heavily influences the final agreement. If you’re anchored on a low starting figure, you might settle for less than you deserve.

How to counteract it:

- Be aware: Recognize when an anchoring effect is influencing your judgment.

- Gather independent data: Don’t rely solely on the first number you see; research a range that fits the context.

- Delay decisions: When possible, avoid making snap decisions after initial figures are presented.

3. Overconfidence Bias: The Danger of Excessive Certainty

What is it? Overconfidence bias is the tendency to be more confident about our knowledge, abilities, or predictions than is objectively warranted.

Why it matters: This bias can lead people to underestimate risks, take uncalculated gambles, or overlook details.

Research Insights: Studies have revealed that expert and novice alike tend to exhibit overconfidence, with a famous example being investment professionals who consistently overestimate their portfolio’s future performance. According to a 2010 study published in the "Journal of Economic Perspectives," overconfidence leads traders to underestimate uncertainty, resulting in excess trading and lower returns.

Real-world Example: Entrepreneurs often fall prey to overconfidence, underestimating the odds of failure. Over 90% of startups ultimately fail within their first five years, yet founders often persist due to inflated self-belief.

How to counteract it:

- Validate predictions with data: Use historical trends and objective metrics to test your assumptions.

- Solicit feedback: Encourage others to challenge your ideas and identify blind spots.

- Adopt probabilistic thinking: Think in terms of likelihoods rather than certainties.

4. Availability Heuristic: The Tyranny of What’s Top of Mind

What is it? The availability heuristic is a mental shortcut where people judge the probability or frequency of an event based on how easily examples come to mind.

Why it matters: This can cause distortion in risk perception, leading to disproportionate fear or optimism.

Research Insights: After highly publicized plane crashes, many people overestimate the danger of flying, despite air travel being far safer statistically than car travel. The vividness and recency of dramatic events make them more "available" in memory.

Real-world Example: During health scares, such as the early stages of a pandemic, people might disproportionately focus on rare complications reported in the media, skewing personal risk assessment.

How to counteract it:

- Seek actual statistics: Instead of relying on salient stories or headlines, look for credible data and research.

- Consider long-term trends: Base judgments on comprehensive evidence rather than anecdotes.

5. Status Quo Bias: The Comfort of Inaction

What is it? Status quo bias describes the preference for maintaining current situations and the tendency to resist change, even when better alternatives exist.

Why it matters: People cling to familiar routines or decisions, often missing out on improvements or innovations.

Research Insights: In studies on organ donation, countries with opt-in policies (requiring active consent) have lower donation rates compared to those with opt-out policies due to status quo bias. This indicates that people stick with default options rather than exert effort to switch.

Real-world Example: In careers, many remain in unsatisfying jobs due to fear of the unknown, comfort with routine, or perceived hassle in switching paths.

How to counteract it:

- Question defaults: Regularly evaluate if the current situation serves your goals.

- Break decisions into smaller steps: Incremental changes can reduce the fear associated with large shifts.

- Envision outcomes: Visualize potential benefits from changing to motivate action.

Conclusion

Understanding the invisible cognitive biases influencing your daily decisions is the first step to mastering them. Confirmation bias narrows your perspective; anchoring distorts your starting points; overconfidence inflates your certainty; the availability heuristic skews risk assessment; and status quo bias chains you to comfort zones. These biases operate quietly but relentlessly, shaping your judgments in subtle ways.

By recognizing these mental traps and deliberately applying strategies to mitigate them—such as seeking disconfirming evidence, examining independent data, embracing probabilistic thinking, grounding decisions in research, and challenging habitual choices—you can free yourself from their influence. The result? Clearer thinking, smarter decisions, and control over your personal and professional destiny.

As Nobel laureate Daniel Kahneman wisely advised, "The confidence we experience as we make a judgment is not a reasoned evaluation of the probability that this judgment is correct." Heed this caution, question your assumptions, and your decisions will no longer be held hostage by bias.

Empower your mind, embrace awareness, and watch your decision making transform.

References

- Kahneman, D., & Tversky, A. (1974). Judgment under Uncertainty: Heuristics and Biases. Science, 185(4157), 1124-1131.

- Nyhan, B., & Reifler, J. (2010). When Corrections Fail: The Persistence of Political Misperceptions. Political Behavior, 32(2), 303-330.

- Odean, T. (1999). Do Investors Trade Too Much? American Economic Review, 89(5), 1279-1298.

- Johnson, E. J., & Goldstein, D. (2003). Do Defaults Save Lives? Science, 302(5649), 1338-1339.

Rate the Post

User Reviews

Popular Posts