Seven Asset Allocation Mistakes New Investors Always Make

9 min read Avoid common pitfalls in asset allocation with our detailed guide tailored especially for new investors seeking smarter portfolio strategies. (0 Reviews)

Seven Asset Allocation Mistakes New Investors Always Make

Investing for the first time is an exciting journey — a chance to grow wealth, achieve financial goals, and gain confidence. However, newcomers often overlook critical components of portfolio construction, particularly asset allocation. Poor allocation can jeopardize returns, amplify risks, and even cause emotional stress.

In this article, we’ll explore the seven key asset allocation mistakes new investors consistently make, supported by real-world insights and actionable advice to help you build a diversified, risk-aware, and balanced portfolio.

Understanding Asset Allocation: The Foundation of Investment Success

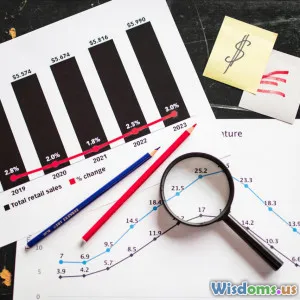

Asset allocation refers to how you divide your investments among various asset classes such as stocks, bonds, cash equivalents, real estate, and alternative assets. This division determines your portfolio’s risk and return profile.

Famed financial advisor David Swensen, who managed Yale’s endowment for decades, emphasized that asset allocation accounts for over 90% of investment returns variability, highlighting its importance. For individual investors, getting asset allocation right is more critical than trying to pick “winning” stocks or time market movements.

1. Neglecting Diversification: "Putting All Eggs in One Basket"

One of the most prevalent mistakes is inadequate diversification. New investors often over-concentrate in a single sector, company, or asset type, chasing hot trends or familiar names.

Real-World Example

During the dot-com bubble burst in 2000, many tech-heavy portfolios collapsed, erasing over 75% of value within a year. Investors who had diversified globally and across asset classes fared much better.

Why Prevention Matters

Diversification spreads risk. When one asset class falters, another may hold steady or even appreciate. This smoothing effect reduces portfolio volatility and safeguards capital.

How To Fix It

Aim to allocate investments across:

- Equities of different industries and geographies

- Bonds with varying maturities and credit qualities

- Alternative assets like real estate or commodities

- Cash or cash equivalents for liquidity

Tools like exchange-traded funds (ETFs) and mutual funds can simplify this process, offering instant diversification.

2. Ignoring Risk Tolerance: One Size Does Not Fit All

Every investor has a unique ability and willingness to endure losses. Overlooking your personal risk tolerance can lead to misaligned portfolios.

Psychological Impact

A high-risk portfolio might generate big gains but can trigger panic selling during downturns if it exceeds comfort levels. Conversely, too conservative an approach may hinder wealth accumulation.

According to a 2021 Vanguard survey, investors who didn’t align portfolios to risk appetite were 40% more likely to abandon their investments prematurely.

Practical Approach

Evaluate risk tolerance honestly — consider:

- Investment timeline

- Income and financial obligations

- Emotional comfort with market swings

Online questionnaires or consultations with financial advisors can help pinpoint your appropriate risk level.

3. Overreacting to Market Fluctuations: The Timing Trap

Attempting to time the market, buying low and selling high on short-term trends, often backfires.

Statistical Reality

Data from Hartford Funds shows that missing the 10 best market days in a decade can cut a portfolio’s return by almost 50%. New investors who panic and sell during dips risk locking in losses and missing rebounds.

Better Strategy

Focus on long-term investing with periodic rebalancing. Consistent contributions and a steady asset mix survive volatility better than impulsive trading.

4. Failing to Rebalance: Letting Your Portfolio Drift

Even the best asset allocation erodes over time as markets move. New investors frequently overlook rebalancing, causing portfolios to drift off target allocations.

Why It Happens

If stocks rally dramatically, your equity allocation might increase beyond your intended risk level. Conversely, if bonds slump, you might end up underdiversified.

Example

Suppose your target is 60% stocks and 40% bonds. After a strong stock market, you may unintentionally shift to 75% stocks and 25% bonds, increasing risk.

Fix it

Rebalance at least annually by selling overweight assets and buying underweight areas to restore your original allocation. This enforces a disciplined "buy low, sell high" strategy.

5. Overlooking Costs and Tax Implications

Asset allocation decisions also influence tax efficiency and investment costs.

Hidden Pitfalls

High turnover rates during frequent rebalancing can trigger capital gains taxes. Choosing funds with excessive fees erodes returns over time.

According to Morningstar, the average mutual fund expense ratio is around 0.5%–1.0%, but even small differences matter over decades.

Smart Practices

- Use low-cost index funds or ETFs prioritized by expense ratios

- Plan cost-efficient rebalancing, utilizing tax-advantaged accounts (IRAs, 401(k)s)

- Consider tax-loss harvesting strategies to offset gains

6. Chasing Performance Instead of Strategy

New investors often shift portfolios chasing last year’s best performing asset classes or funds, ignoring long-term strategy.

Risks of Chasing Trends

Performance chasing leads to buying high and selling low. For instance, prior to the 2008 financial crisis, emerging markets surged; many naive investors piled in near the peak just before sharp declines.

Strategic Approach

Develop and stick to a forward-looking allocation plan aligned with financial goals and risk tolerance.

Incorporate lessons from Nobel laureate Harry Markowitz’s Modern Portfolio Theory about balancing risk and return through planned diversification.

7. Neglecting Emergency Cash Allocation

Finally, new investors sometimes allocate 100% to market investments without a liquid cash reserve.

Why This is Costly

Unexpected expenses might force you to liquidate investments at unfavorable prices. This disrupts compound growth and causes unnecessary losses.

Best Practice

Maintain an emergency fund covering 3-6 months of living expenses in cash or ultra-safe instruments before fully committing funds to risk bearers.

This buffer helps withstand market downturns without rash decisions.

Conclusion: Asset Allocation is Your Investment Compass

Mastering asset allocation is foundational for investment success. By avoiding mistakes like lacking diversification, misjudging risk tolerance, timing the market, neglecting rebalancing, overlooking costs and taxes, chasing performance trends, or failing to hold cash reserves, new investors can build portfolios resilient to volatility and aligned with personal goals.

Remember Warren Buffett’s wisdom: "The first rule is not to lose money. The second rule is not to forget the first rule." Smart allocation helps protect capital first and grow it strategically.

Start with a thoughtful plan, stay disciplined, and your portfolio will reward your patience and prudence with long-term growth and peace of mind.

Additional Resources

- Vanguard’s "Principles for Investing Success"

- Morningstar’s Fund Fee Comparison Tool

- CFP Board’s Risk Profiling Questionnaire

Ready to refine your asset allocation? Evaluate your current portfolio using these principles and seek guidance to tailor a plan that lasts a lifetime.

Rate the Post

User Reviews

Popular Posts