Are US Tariffs Creating Opportunity for Latin American Exporters

30 min read How US tariffs are reshaping supply chains and creating nearshoring openings for Latin American exporters—especially Mexico, Brazil, and Central America—in autos, electronics, and agri-food, amid compliance and logistics challenges. (0 Reviews)

Are US tariffs creating opportunity for Latin American exporters? The short answer is yes, but not for everyone and not automatically. Tariff walls are reshaping global supply chains, pushing buyers to reroute orders and invest closer to the US market. In that rerouting lies a window for Latin American firms with the right mix of compliance, capacity, and speed-to-market. This article unpacks where the real openings are, what the data already shows, and how exporters can move from talk to contracts.

What exactly changed in US tariff policy—and why that matters now

The US has long used targeted tariffs for trade defense, but since 2018 the scope and staying power of these measures have grown. Two buckets matter most for Latin America

- Section 301 tariffs on goods from China, initially imposed in 2018 and updated in 2024, target a long list of products: machinery, electronics, batteries, EVs, solar cells, medical supplies, and more. In 2024, the US increased tariffs on several China-origin items, notably pushing electric vehicle tariffs to roughly 100 percent, solar cells and modules to about 50 percent, and raising certain semiconductor and battery-related tariffs, with some phased increases into 2025–2026. The practical impact: US buyers face higher landed costs and more compliance checks if they source these categories from China.

- Section 232 tariffs or quota arrangements on steel and aluminum treat imports as a national security issue. Mexico, Canada, and a few partners have exemptions or quota deals, but others—Brazil and Argentina, for example—operate under negotiated limits for steel. That shapes where US buyers place orders for metal-intensive projects.

Pair these with other policies and the picture gets clearer

- USMCA rules of origin give tariff-free treatment to qualifying goods made in Mexico and Canada, including autos with strict regional value and labor value content requirements.

- The Inflation Reduction Act ties EV tax credits to North American final assembly and to critical minerals processed or extracted in the US or free trade agreement partners. Chile and Peru, with FTAs, are well placed for lithium and copper; Mexico qualifies on final assembly for autos and many components, subject to content rules and foreign-entity-of-concern restrictions.

- Forced labor enforcement, particularly the Uyghur Forced Labor Prevention Act (UFLPA), is prompting importers to audit supply chains for Xinjiang-linked materials. This has reconfigured orders in apparel, solar, and electronics subcategories.

For Latin America, tariffs create three channels of opportunity

- Trade diversion: Orders shift away from tariffed sources to alternative suppliers offering lower duty risk.

- Nearshoring: Buyers redesign networks to shorten transit times and reduce geopolitical and compliance exposure.

- Preferential access: FTA rules and regional content thresholds tilt the playing field toward Mexico, Chile, Peru, Colombia, Costa Rica, and others with US agreements.

The window is open, but it is not blanket. It varies by sector, by rule of origin detail, and by a firm’s ability to verify inputs.

Evidence of trade diversion: who is actually gaining

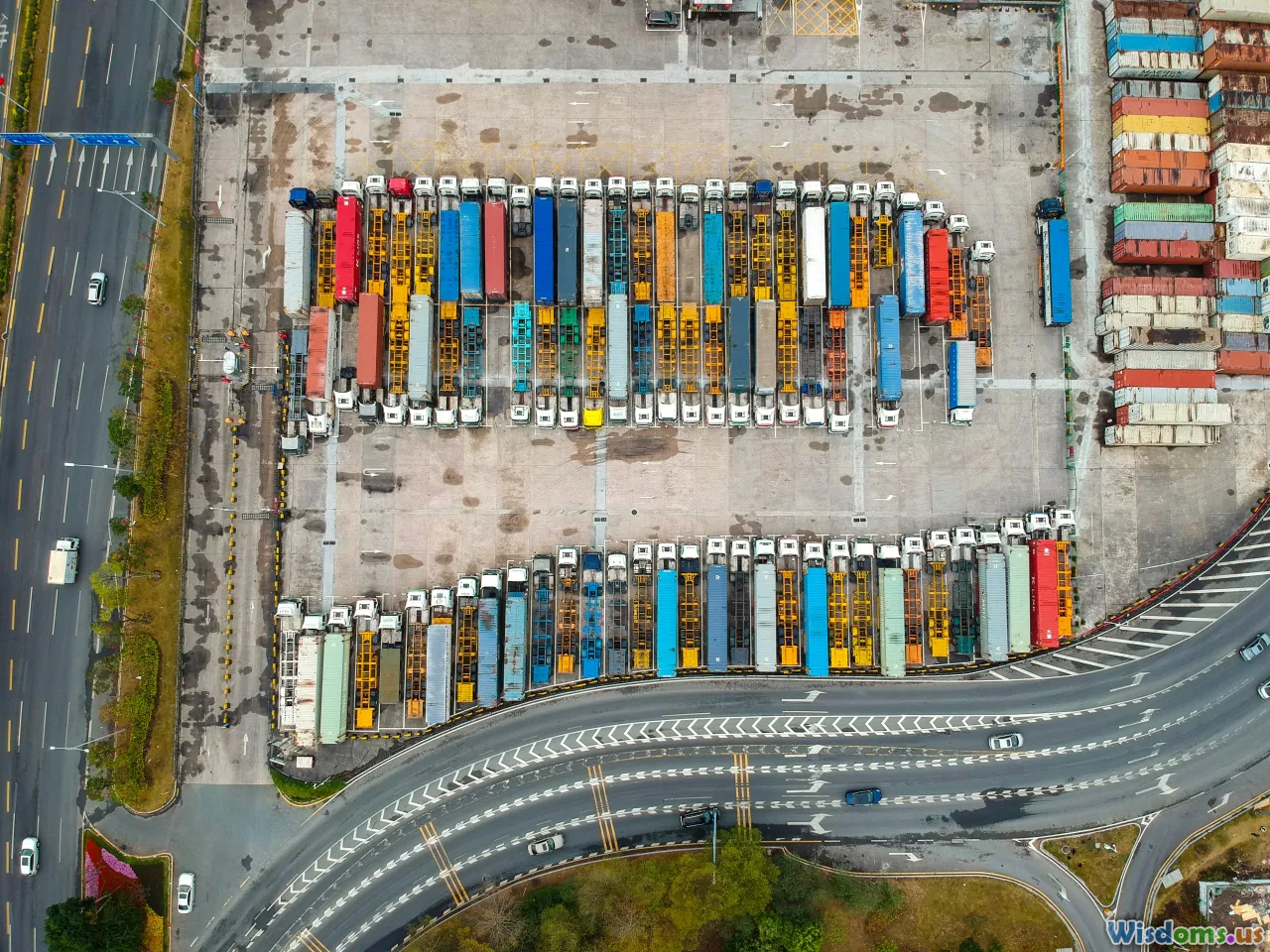

Recent trade flows tell a clear story. Even as global trade cooled in 2023, Mexico overtook China as the US’s largest single goods trading partner. The drivers include tightened US rules of origin in autos under USMCA, persistently higher US tariffs or enforcement risk on China-origin goods, and a corporate push toward resilience after pandemic-era disruptions.

- Mexico’s exports to the US in autos, auto parts, electronics assembly, medical devices, and home appliances set records or near-records in 2023–2024. Cross-border rail and truck volumes increased, and industrial real estate along the northern Mexican border saw historically low vacancy rates.

- Central America benefited in textiles and apparel, particularly within CAFTA-DR’s yarn-forward rules that integrate US yarns and fabrics into regional garment production. Speed-to-market post-pandemic brought orders for basics and athleisure that once moved through longer Asia cycles.

- South America’s gains are more sector-specific. Brazil expanded shipments of crude oil and selected manufactured goods, though steel remains constrained by quota or trade remedies in some lines. Chile and Peru deepened exports of copper and related semi-finished products, while Chile’s lithium rose in strategic importance to US battery supply chains because it qualifies under US free trade agreement criteria.

Not every country gained. Some commodity exporters faced price downswings in 2023; others were hit by antidumping and countervailing duty cases. Where Latin America is winning, it’s typically where rules of origin are favorable and logistics are short-cycle.

Sectors where Latin America is best positioned to capture demand

- Autos and auto parts

- Why it’s attractive: USMCA offers duty-free access for qualifying North American content. Strict rules of origin (regional value content and labor value content) encourage deeper supplier localization.

- What’s moving: Wiring harnesses, seating systems, metal stampings, dashboards, HVAC modules, and other Tier 2–3 components have seen steady nearshoring. Final vehicle assembly in Mexico remains strong, particularly in SUVs, pickups, and compact cars.

- New angle: EV-related parts. As FEOC restrictions tighten on Chinese battery components and critical minerals, US buyers are looking for North American or FTA-compliant alternatives. This favors cathode/anode precursor projects, aluminum housings, thermal management, and high-voltage wire systems produced in Mexico or the US.

- Batteries and critical minerals

- Why it’s attractive: The IRA’s clean vehicle credit hinges on critical minerals extracted or processed in the US or FTA partners. Chile and Peru are central to copper, while Chile is pivotal to lithium carbonate and hydroxide.

- What’s moving: Long-term offtake agreements between US or North American battery and cathode makers and Chilean lithium suppliers help unlock project financing. Some midstream processing proposals in Mexico and the US aim to convert imported lithium into IRA-compliant battery materials.

- Watchouts: Argentina has world-class lithium but no US FTA; policy interpretations matter. Firms should monitor whether any future critical minerals understandings change eligibility and how FEOC rules apply to ownership and processing.

- Solar and power electronics

- Why it’s attractive: Higher US tariffs and enforcement on China-origin solar cells/modules and allegations of circumvention in parts of Southeast Asia have buyers scouting for alternative assembly sites. US demand remains robust for commercial and utility-scale projects.

- What’s moving: Mexico-based module assembly, frames, junction boxes, inverters, and balance-of-system components have gained attention. While wafer and cell capacity remains concentrated in Asia, suppliers that can trace non-restricted polysilicon and cells and finalize assembly in Mexico can shorten lead times to the US.

- Watchouts: UFLPA documentation must be watertight. Buyers increasingly demand traceability from polysilicon through modules. Weak documentation equals delays at US ports.

- Machinery, appliances, and electronics assembly

- Why it’s attractive: Many SKUs carry medium US MFN tariffs that, combined with logistics savings and lower disruption risk, make nearshoring viable even without special preferences. For Mexico, USMCA compliance can eliminate duties entirely.

- What’s moving: Home appliances, HVAC units, consumer electronics sub-assemblies, and industrial control panels. Many products benefit from Mexico’s deep base of tooling, die, and injection molding shops.

- Metals and engineered components

- Why it’s attractive: Regional buyers want shorter lead times for castings, forgings, and fabrications. North and Central America offer workable lead times and freight costs for mid-volume runs.

- Watchouts: Steel and aluminum face a thicket of quotas and trade remedies. Brazil ships significant semi-finished products under quota arrangements, but exporters must navigate license timing and product-level restrictions. Mexico generally enjoys more favorable treatment under USMCA, but specific AD/CVD orders can still apply by product.

- Agrifood with logistics edge

- Why it’s attractive: Freshness and perishables value speed. Latin America’s proximity to US consumers is a durable advantage.

- What’s moving: Avocados, berries, tropical fruit, coffee, processed foods, and beverages. Cold chain investments along the US-Mexico border and Gulf ports help preserve quality and reduce spoilage.

Mexico vs Central America vs the Andean region vs the Southern Cone: a practical comparison

Mexico (USMCA)

- Strengths: Deep manufacturing ecosystem; tariff-free access for qualifying goods; rail and truck connectivity; experienced customs brokers; growing EV and electronics clusters.

- Constraints: Border congestion at peak; electricity availability and pricing in some states; labor tightness in principal hubs; evolving security considerations; strict auto rules of origin compliance.

- Best bets: Autos, electronics, appliances, industrial equipment, solar components, medical devices, selected steel-aluminum fabrications.

Central America (CAFTA-DR: Costa Rica, El Salvador, Guatemala, Honduras, Nicaragua, Dominican Republic)

- Strengths: Yarn-forward apparel integration with US textiles; fast turnarounds; competitive labor in apparel and light manufacturing; Costa Rica’s strong medical device and electronics niches.

- Constraints: Scale limits in heavy industry; political and sanctions risk in certain countries; infrastructure variations by corridor.

- Best bets: Apparel basics and athleisure; cut-and-sew with US yarns; medical device assembly in Costa Rica; BPO and shared services tied to manufacturing.

Andean region (Peru, Colombia; Ecuador without a US FTA)

- Strengths: Peru and Colombia hold FTAs with the US; solid agrifood and minerals base; emerging metal-mechanic and packaging sectors.

- Constraints: Logistics to US East Coast favorable, but West Coast routings depend on Panama Canal conditions; Ecuador’s lack of FTA keeps duties on many manufactured goods.

- Best bets: Copper and concentrates (Peru), fishmeal and agrifood, specialty coffee, apparel in niche categories under FTA preferences (Peru/Colombia), packaging and paper products.

Southern Cone (Brazil, Argentina, Uruguay, Paraguay)

- Strengths: Industrial depth in Brazil; agrifood scale across the region; aerospace in Brazil; resources including iron ore, oil, pulp, and sugar.

- Constraints: No US FTA; MFN duties apply on many manufactured items; Section 232 steel quotas; episodic AD/CVD cases (e.g., biodiesel from Argentina historically). Currency volatility can cut both ways.

- Best bets: Crude oil and fuels, aircraft and parts, paper and pulp, orange juice, sugar under quota, selected machinery where tariff lines are low or buyers accept duties for quick delivery.

How to win the diverted demand: a step-by-step playbook for exporters

- Map tariff exposure and rules of origin

- Classify your SKUs at the 10-digit level to identify MFN duty rates and any AD/CVD risks.

- For USMCA, calculate regional value content using both net cost and transaction value methods to see which yields compliance. For autos and certain parts, validate labor value content thresholds and core parts requirements.

- For CAFTA-DR apparel, validate yarn-forward origins and maintain documentation from yarn to fabric to cut-and-sew.

- Engineer your bill of materials for compliance

- Substitute inputs from FTA partners to reach content thresholds, particularly for electronics subassemblies and auto parts.

- For IRA-related opportunities, ensure critical minerals and battery components are sourced from approved jurisdictions and are not tied to foreign-entity-of-concern restrictions.

- Bake traceability into procurement contracts: require suppliers to provide origin affidavits and audit rights.

- Design for speed-to-market

- Co-locate final assembly near border crossings with robust customs infrastructure.

- Pre-clear customs documentation, use trusted trader programs, and align packaging for cross-dock efficiency.

- For e-commerce and B2B replenishment, use near-border fulfillment centers to shorten cycle time.

- Build compliance muscle

- Implement a digital document vault for certificates of origin, mill test reports, and supplier declarations.

- Train teams on UFLPA red flags and on product-specific compliance (e.g., medical device labeling, energy efficiency standards, automotive safety compliance).

- Engage experienced US customs brokers early to validate tariff classifications and potential prior disclosure needs.

- Price with landed-cost precision

- Quote Delivered Duty Paid (DDP) options when competitive, but model fuel surcharges, detention/demurrage, border wait variability, and return logistics.

- Hedge currency when margins are thin and exposure is long.

- Finance growth smartly

- Approach US buyers with capacity-backed ramp plans and performance bonds.

- Tap regional development banks and the US International Development Finance Corporation for expansion financing in sectors of strategic interest.

- Partner where it pays off

- Joint ventures with US or Mexican distributors accelerate certifications and aftermarket reach.

- For complex parts, collaborate with toolmakers and automation integrators to lift quality and throughput.

Logistics realities: proximity helps, but execution decides winners

- Border infrastructure: Key crossings like Laredo–Nuevo Laredo, El Paso–Ciudad Juárez, and Otay Mesa carry intense volumes. Trusted trader programs such as CTPAT and FAST can meaningfully reduce wait times for qualifying shippers. Plan production around peak crossing hours and seasonal surges.

- Rail corridors: Cross-border intermodal has grown, supported by long-haul routes linking Mexican manufacturing hubs with US Midwest and Gulf destinations. For bulky components, rail’s cost advantage is material; ensure packaging withstands longer consolidation cycles.

- Gulf and Pacific ports: Gulf ports support short-sea services and refrigerated cargo into the US Southeast and East Coast. Mexico’s Pacific ports provide alternatives to West Coast congestion, though drayage and internal rail capacity must be secured.

- Panama Canal: Drought-related draft restrictions in 2023–2024 forced scheduling adjustments. While nearshoring reduces canal dependence, Andean exporters to the US East Coast should retain contingency routings.

- Cold chain: Modern cold storage near the border and in US distribution nodes can offset costlier airfreight. Data loggers and temperature-controlled packaging are becoming a standard ask from US buyers.

Risks and headwinds to price in now

- AD/CVD cases: Apparel trims, steel, aluminum extrusions, biodiesel, and shrimp have all seen petitions over the years. Even winning a case ties up cash; losing can erase margins. Monitor petitions and keep a reserve for retroactive duties.

- Policy shifts: The 2026 USMCA review could tweak rules of origin. A future US administration might broaden tariffs or change enforcement priorities. Build scenario plans for tariff shocks.

- FEOC and ownership structures: For IRA-eligible supply chains, ownership by or contracts with restricted entities can disqualify products. Trace not just materials but corporate control.

- Labor and environmental standards: US buyers increasingly require social auditing, living-wage progress, and environmental impact metrics. Forced labor screening is non-negotiable.

- Infrastructure strains: Electricity-price volatility and grid capacity in industrializing Mexican states can affect uptime. Water availability matters for battery and electronics projects.

- Security and cargo theft: Invest in route planning, geofencing, and vetted carriers. Insurance premiums are rising where theft hotspots persist.

Three case snapshots to make it concrete

- Mexican wiring harness producer climbs the value chain

- Situation: A Tier 2 harness maker in Coahuila supplied ICE vehicle programs with stable volumes. As US buyers accelerated EV platforms, the importer sought FEOC-safe high-voltage harnesses.

- Action: The supplier partnered with a European connector firm to qualify new components with FTA-compliant sources, invested in automated crimping and testing, and shifted copper procurement to a regional mill with full origin documentation.

- Result: Within 14 months, the supplier won two EV platform awards from a US automaker, increasing average selling price per vehicle by 35–45 percent while maintaining USMCA compliance. Warranty returns declined thanks to inline testing dashboards.

- Chilean lithium into North American cathode material

- Situation: A US cathode startup needed IRA-compliant lithium hydroxide with transparent provenance.

- Action: The startup signed a multi-year offtake with a Chilean producer, with shipment-level assay and chain-of-custody reporting. A tolling partner in North America completed final processing steps.

- Result: The product qualified for critical mineral content criteria, unlocking the buyer’s eligibility for EV tax incentives and facilitating project financing at lower cost of capital.

- Honduran apparel firm wins on speed-to-shelf

- Situation: A US retailer needed to reduce replenishment lead times on athleisure lines from 110–120 days out of Asia to under 45 days.

- Action: The Honduran manufacturer integrated US yarn inputs, installed automated cutting rooms, and adopted weekly fabric dye lots to reduce batch size. It established a cross-dock in Texas to support store-level allocation.

- Result: Total lead time fell to 38–42 days, in-stock rates improved 9 percentage points, and markdowns dropped. Despite slightly higher FOB costs, gross margin rose on the line.

Metrics that signal whether the opportunity is real for you

- Share of US imports by origin for your HS codes: Track monthly shifts; a sustained drop from China and rise in Mexico or CAFTA-DR markets indicates durable diversion.

- Border crossing times and carrier capacity: Rising delays might negate your speed advantage; pre-book slots and diversify lanes.

- Industrial park vacancy and power tariffs: Tight vacancy correlates with rising wages and utility costs; scout secondary cities early.

- AD/CVD docket activity in your category: A spike in petitions foretells risk; consider product design tweaks or alternative inputs.

- US buyer inventory days on hand: Lower retailer inventories tend to reward nearshore replenishment.

- Exchange rates and inflation: FX swings can create windows to lock multi-year pricing or, conversely, force renegotiations.

Quick comparison: Latin America vs Southeast Asia vs near-Europe for US buyers

- Transit times

- Mexico to US by truck: 1–5 days to most distribution centers.

- Central America to US Gulf/East Coast by sea: roughly 4–10 days, depending on port pair.

- Southeast Asia to US West Coast by sea: typically 14–20 days, longer to East Coast via Panama.

- Near-Europe (Turkey, North Africa) to US East Coast: roughly 12–16 days.

- Tariff environment

- Mexico and many Central American and Andean exports can enter duty-free under USMCA or CAFTA-DR/FTAs if compliant.

- Southeast Asia often pays MFN rates unless a special program applies and faces more UFLPA scrutiny in certain categories.

- Capability

- Southeast Asia retains deep capacity in electronics, apparel, and solar cells. Latin America’s strengths are autos, appliances, medical devices (Costa Rica), apparel closer to basics, and selective electronics assembly.

- Flexibility

- Latin America offers superior responsiveness and site visits. For replenishment models and seasonal spikes, the proximity advantage often outweighs unit-cost deltas.

Tips for US buyers considering Latin American suppliers

- Start with SKU triage: Move replenishment and high-variability SKUs first, where proximity pays the largest dividend.

- Co-invest in tooling and QA: Shared CAPEX aligns incentives and accelerates PPAP and first-article approval.

- Validate compliance early: Run full mock entries with customs brokers and vet UFLPA documentation before live shipments.

- Lock logistics capacity: Secure cross-border trucking and, where relevant, rail slots. Consider near-border DCs for final kitting.

- Build dual sourcing: Pair a Latin American supplier with a residual Asia source during ramp. Reduce the Asia share as on-time delivery and yield stabilize.

A realistic timeline for capturing nearshoring gains

- 0–3 months: Product selection, tariff mapping, supplier pre-qualification, and sample orders.

- 3–6 months: Pilot runs, packaging validation, customs pre-clearance tests, and QA audits.

- 6–12 months: PPAP or equivalent approvals, volume ramp, and EDI integration. For apparel, shift seasonal lines gradually; for auto/electronics, secure long-lead tooling early.

- 12–24 months: Localize sub-suppliers to improve USMCA/FTA content and cut risk. Explore financing for capacity expansion.

Common pitfalls—and how to avoid them

- Assuming any Mexico-made product is automatically USMCA-qualified: It is not. Without proper origin calculation and documentation, duty-free treatment can be denied.

- Underestimating UFLPA: Documentation gaps can delay shipments for weeks. Map cotton, polysilicon, and cobalt supply chains in particular.

- Ignoring power and water: Validate industrial park utilities and redundancy. Consider on-site generation or PPAs where feasible.

- Overreliance on one border crossing: Diversify to secondary ports of entry and maintain contingency routings.

- Not budgeting for compliance: Allocate for audits, legal counsel on trade remedies, and digital traceability tools.

Are the opportunities durable—or just a temporary reshuffle?

Three forces suggest durability

- Policy stickiness: Section 301 tariffs have proven resilient across political cycles, and 2024 updates extended their reach. Forced labor enforcement is bipartisan. While rates can change, the compliance spotlight is not going away.

- Corporate resilience logic: Shorter supply chains and regional redundancy are now standard boardroom priorities. The just-in-time model is evolving into just-in-case plus regional pooling.

- Industrial momentum: Clusters in northern Mexico, medical devices in Costa Rica, and energy-transition metals in the Andes have hit critical mass. Supplier ecosystems and skilled labor pools deepen with each incremental plant.

Yet outcomes will diverge. Countries with reliable infrastructure, transparent customs, and workforce development will compound their gains. Others may attract a nearshoring headline but struggle to scale. Exporters that professionalize compliance and invest in automation will edge out those that bank on proximity alone.

The tariff era is not a magic wand; it is a sorting mechanism. Latin American firms that pair proximity with proof—of origin, of quality, of delivery—will find that the US tariff wall does more than block. It builds a gate for those prepared to walk through it.

Business Manufacturing Global Business & International Trade International Trade Latin America Supply Chain Strategy US tariffs nearshoring USMCA Section 301 rules of origin Mexico exports Brazil manufacturing Central America apparel supply chain diversification anti-dumping foreign direct investment logistics capacity

Rate the Post

User Reviews

Other posts in Global Business & International Trade

Popular Posts