How Offshore Shell Companies Shield Billionaires From Taxes

16 min read Discover how offshore shell companies help billionaires minimize tax liability through complex structures and legal loopholes. (0 Reviews)

How Offshore Shell Companies Shield Billionaires From Taxes

It’s a financial strategy envied by some, condemned by others, and, for decades, the subject of headline-grabbing leaks—offshore shell companies. In today’s interconnected economy, the ultra-wealthy increasingly turn to complicated offshore structures to minimize their tax liability and protect vast fortunes. But what exactly are offshore shell companies, how do the world’s richest use them, and what does this mean for global economies and the average taxpayer? Join us as we peel back the layers on one of finance’s most controversial tactics.

What Are Offshore Shell Companies?

Offshore shell companies are legal entities—often with no active business operations—incorporated outside a person’s country of residence, typically in jurisdictions known for low taxes and strict secrecy laws. "Shell" refers to their empty nature: existing mainly on paper, sometimes just an address, a director, and nothing more. Billionaires and multinational corporations rely on shell companies for moving funds, holding assets, and lowering taxes.

Consider the British Virgin Islands, Panama, and the Cayman Islands. These so-called tax havens are famous for corporate-friendly regulations and negligible income taxation. For instance, the Panama Papers leak in 2016 exposed more than 200,000 such entities set up, some for legitimate purposes, but many seemingly to shelter wealth from taxes and prying eyes. These companies can hold assets like yachts, real estate, or shares in other businesses—often shielding their ultimate owners from disclosure.

Key characteristics of offshore shell companies:

- Usually located in tax havens.

- Have minimal or no actual business operations.

- Provide anonymity for the ultimate beneficial owner (UBO).

- Can open bank accounts, hold assets, or sign contracts.

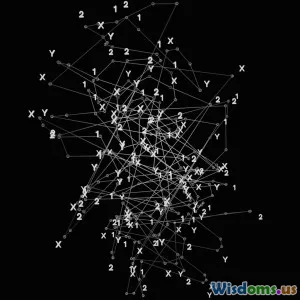

The Mechanics: How Offshore Shell Companies Operate

To understand how these companies help the ultra-rich reduce taxes, let’s break down a typical structure:

1. Creation and Nominee Services

Setting up a shell company can be incredibly easy, sometimes viewable online with just a passport scan and fee. "Nominee" directors and shareholders—stand-ins for the real owners—mask the beneficiary’s identity. Corporate service providers coordinate the paperwork, file minimal records, and arrange mail forwarding.

2. Asset Transfers and Invoicing

The key power of shell companies is moving money and assets offshore, away from local regulators and tax authorities. Let’s say a billionaire owns a yacht registered to a Cypriot shell company. As far as their home country tax office is concerned, the yacht is property of an overseas firm, often side-stepping expensive taxes or asset disclosures.

Businesses may also route transactions through shells. For example, a U.S.-based company could pay inflated consulting fees to its own offshore entity, effectively moving profits to low-tax jurisdictions.

3. Banking Secrecy and Layering

Opening bank accounts with shell companies adds another firewall. When regulators try to trace ownership or the purpose of funds, all they see is a blur of numbered accounts registered to nondescript corporations; actual owners are hidden behind multiple legal veils, frequently across several different countries.

These steps can be multiplied, with assets hopping from one shell to another, complicating efforts to track money flows and applying different layers of legal protections.

Real-World Examples: Leaks That Changed How We See the Ultra-Rich

Several landmark leaks have revealed just how ubiquitous offshore shell companies are among the world’s elite.

Panama Papers (2016)

A massive trove of data from law firm Mossack Fonseca demonstrated how the rich and powerful—including heads of state, celebrities, and corporate titans—routinely used shell companies to obscure wealth. Names ranging from the then-prime minister of Iceland to soccer superstar Lionel Messi appeared in the documents. An estimated $1.2 billion in U.S. assets and secret trusts was uncovered, much of it held offshore.

Paradise Papers (2017)

Millions of documents from offshore law firm Appleby revealed prominent politicians, tech moguls, and business magnates stashing billions abroad. Notably, Queen Elizabeth II’s private estate, Apple, and the trustees behind Bono and Shakira were named, exaggerating public scrutiny and uproar.

Pandora Papers (2021)

With nearly three terabytes of data, the Pandora Papers outstripped all earlier leaks. King Abdullah II of Jordan, the Czech Prime Minister, and many U.S. billionaires were connected to offshore assets ranging from London mansions to superyachts. Not all such activities are illegal, but many highlighted how offshore entities enable extraordinary tax savings and secrecy.

Tax Strategies Enabled By Offshore Shell Companies

Why do billionaires go to such lengths? Primarily to legally or quasi-legally reduce their tax bills, preserve capital, and maintain privacy.

Common schemes include:

-

Profit Shifting: By invoicing transnational business services from low-tax offshore shells, companies can make profits appear where taxes are minimal. For example, Google Ireland’s unique licensing agreements enabled it to move most of its non-U.S. profit through Bermuda, cutting billions from its tax bill.

-

Deferred Taxation: Unlike ordinary individuals, the wealthy can defer taxation indefinitely. By holding assets in overseas companies, gains aren’t recognized at home until funds are repatriated (sometimes never, if spent via offshore company perks or credit cards).

-

Inheritance Planning: Creating complicated webs of trusts and shell companies ensures that wealth is passed to heirs outside of normal inheritance tax regimes. For instance, art collections and luxury real estate can be owned offshore, inherited as transfer-of-shares rather than asset sales.

-

Personal Asset Protection: Ultra-wealthy individuals can ringfence assets against lawsuits, divorces, or creditor claims using opaque offshore structures.

Are Offshore Shell Companies Legal or Illegal?

The existence of offshore shell companies is not inherently illegal. They’re often established for legitimate reasons—such as facilitating international trade or safeguarding against political instability. However, when used for tax evasion, money laundering, or sanctions busting, they cross a legal line.

The distinction rests on intent, transparency, and compliance with home-country regulations. The European Union maintains a constantly updated blacklist of tax havens, and both the U.S. and U.K. have toughened rules to force disclosure of beneficial ownership. Even so, enforcement lags behind the financial engineers’ creativity.

A revealing example: In the United States, all 50 states allow the formation of anonymous entities. Delaware, Nevada, and Wyoming are favorites for opaque company registrations—with more than one million shells registered in Delaware alone. These states often require less information than most European or Caribbean havens. This legal gray area means even domestically incorporated shell companies present transparency challenges.

Offshore arrangements become problematic when used to intentionally conceal ownership, evade taxes, launder illicit gains, or fund criminal activity.

How Governments Are Responding

Tax authorities and international bodies are fighting back through legislation, improved reporting requirements, and information sharing.

-

Common Reporting Standard (CRS): Developed by the OECD, this pact requires participating countries (over 100) to share bank and account data across borders, making it harder to hide money offshore.

-

U.S. Foreign Account Tax Compliance Act (FATCA): FATCA obliges foreign banks to report U.S. clients holding more than $50,000, increasing IRS reach worldwide.

-

Beneficial Ownership Registers: Several countries—including the UK and EU member states—now require companies to disclose real owners. While some registers are public, others (like in the U.S.) are only accessible to law enforcement.

Yet, in practice, compliance varies widely, and legal professionals are adept at identifying new loopholes as old ones close. Jurisdictions such as the British Overseas Territories and Switzerland have sometimes only reluctantly joined global transparency efforts.

Winners and Losers: The Impact on the World Economy

The ability of billionaires to avoid taxes via offshore shell companies has profound consequences.

Winners

- The ultra-rich and multinational firms: Reduce tax bills to single-digit percentages, yield bigger fortunes, and shield themselves from political or public scrutiny.

- Tax haven economies: Jurisdictions like the Caymans and BVI generate enormous revenue by hosting shell company incorporations, employing specialized lawyers, accountants, and trust company professionals.

Losers

- National governments: Lose hundreds of billions in tax revenue annually. The International Monetary Fund (IMF) estimates up to $600 billion is lost each year by governments worldwide due to illicit financial flows and international tax avoidance.

- Ordinary taxpayers: With lost revenue from the wealthiest and corporations, governments often burden average citizens with higher taxes or reduced services.

- Social programs: Funding for healthcare, education, and infrastructure suffers as treasury coffers are starved.

Unmasking the Human Side: When Shell Games Go Wrong

The shadowy offshore world isn’t immune to risk for those involved. Whistleblowers, such as Panama Papers source John Doe, face threats and exile. Public outrage has forced resignations—a notorious case is Sigmundur Gunnlaugsson, Iceland’s PM, who stepped down when linked to an undisclosed offshore entity.

More brutally, not all exposure leads to restitution. For example, while multiple investigations followed the Pandora Papers, few billionaires actually saw criminal charges. Complex international law, vast financial resources for legal defense, and the ambiguous legality of many arrangements ensure that dramatic leaks rarely equate to severe penalties. Still, public scrutiny helps drive reform and greater transparency.

The Evolving Landscape: Future Scenarios

Rapid advances in regulatory technology (RegTech) and data analytics provide hope for improved oversight. Artificial intelligence, blockchain analysis, and coordinated international enforcement are helping to track the movement of suspicious funds. Emerging startups and investigative journalists—like those at the International Consortium of Investigative Journalists (ICIJ)—use sophisticated tools to analyze leaked documents and share findings with the public.

However, financial innovation marches on. Encrypted communications, privacy coins, and new havens are emerging, creating a perpetual game of cat and mouse between billionaires’ advisers and government watchdogs. Policymakers must continually adapt, and ordinary citizens can press for more transparency.

Strategies for Governments and Citizens

With so much at stake, what can institutions, policymakers, and citizens do?

Policy Recommendations:

- Strengthen and harmonize beneficial ownership disclosure rules globally.

- Punish corporate and professional enablers who design illicit schemes.

- Encourage whistleblowing with robust protections and incentives.

- Support public reporting and journalism to keep offshore issues visible.

Individual Actions:

- Demand transparency and accountability from elected officials.

- Support NGOs and watchdogs focused on global financial fairness.

- Stay informed: For instance, ICIJ's databases are now publicly searchable, helping anyone see connections hidden in leaks.

If you’re concerned as a professional or entrepreneur about your own tax strategy, consult reputable, law-abiding advisers; aggressive or clandestine offshore schemes can carry hefty personal and financial risks as authorities tighten the noose.

As the world grows smaller, the global fight over transparency, fairness, and fiscal responsibility becomes ever fiercer. The shadowy business of offshore shell companies is likely to remain a battlefront—one where both laws and ethics are being redefined in real time.

Rate the Post

User Reviews

Popular Posts