Exposing Switzerland’s Secret Banking Networks and Hidden Transactions

8 min read Investigate the labyrinth of Switzerland’s secret banking networks and uncover the hidden transactions shaping global finance. (0 Reviews)

Exposing Switzerland’s Secret Banking Networks and Hidden Transactions

Introduction: The Allure of Swiss Banking Secrecy

The mystique surrounding Switzerland’s banking system is legendary. Often romanticized as a fortress of safety and discretion, Swiss banks have attracted millions of customers seeking confidentiality for their assets. However, beneath this veneer lies a complex web of secretive banking networks and hidden transactions that have raised ethical, legal, and economic questions worldwide.

This article aims to unravel the layers of this enigma — tracing the origins of Swiss banking secrecy, dissecting the mechanisms enabling concealed financial activity, and discussing their wide-reaching implications. Prepare to dive deep into a clandestine financial landscape that few truly understand.

Historical Context: Birth of Swiss Banking Secrecy

Swiss banking secrecy dates back to 1934 with the enactment of the Swiss Banking Law, particularly Article 47 of the Federal Banking Act. This legislation made it a criminal offense for bankers to divulge the identity of account holders without consent, effectively institutionalizing discretion.

Why Secrecy?

Switzerland’s political neutrality during the tumultuous early 20th century, coupled with a stable economy, made it appealing to individuals and entities desiring security and confidentiality. Secret accounts shielded European and global elites during periods of war, economic uncertainty, or political persecution.

For example, during World War II, Swiss banks were alleged to have held onto accounts belonging to victims of war atrocities, igniting decades-long controversies and reparations disputes.

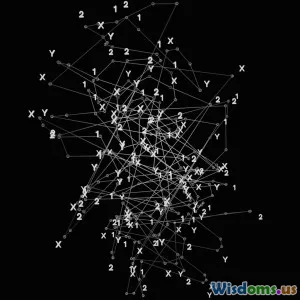

Anatomy of Secret Banking Networks

Swiss banking secrecy is not merely a product of law but a mosaic crafted from legal structures, financial instruments, and institutional frameworks.

1. Shell Companies and Trusts

Swiss law facilitates the formation of shell companies and trusts that act as veils, masking the ultimate beneficiaries of assets. By registering assets under opaque corporate entities, ownership becomes nearly invisible.

An illustrative case is the "Panama Papers," where Swiss entities factoring into offshore shell corporations concealed fortunes worth billions.

2. Nominee Accounts

Another layer involves nominee accounts, where the recorded account holder is not the true beneficial owner. These are often managed by trusted representatives, shielding the real owner’s identity from public and regulatory scrutiny.

3. Banking Technologies and Cryptography

Modern Swiss banks deploy cutting-edge encryption and cybersecurity frameworks to provide impenetrable confidentiality for clients. Combined with stringent access controls and internal secrecy rules, these technologies safeguard transaction records from both external breaches and internal leaks.

4. Cross-Border Networks

Banks collaborate across borders using correspondent accounts and intermediaries, enabling funds to move discreetly across jurisdictions. This international cooperation in banking can cloak the origin and destination of transactions, complicating investigative efforts.

Hidden Transactions: Methods and Examples

The secret banking networks facilitate various hidden transactions ranging from legal tax planning to illicit financial transfers.

Tax Evasion and Avoidance

Swiss banks historically attracted clients aiming to minimize tax liabilities by concealing income or assets. Though reforms post-2008 financial crisis have increased transparency, loopholes remain exploitable.

For example, many high-net-worth individuals reportedly used Swiss accounts to shield income and investments from their country’s tax authorities.

Money Laundering

The confidentiality offered has unfortunately been exploited for money laundering. Criminal organizations and politically exposed persons (PEPs) have trafficked illicit funds through Swiss banks, disguising their origins.

The 2014 "FinCEN Files" investigation revealed how Swiss banks, among others, were involved in suspicious transactions worth billions linked to drug trafficking and corruption.

Arms Trafficking and Sanctions Evasion

Covert transaction networks have enabled sanctioned entities to move funds through Swiss accounts, circumventing international embargoes.

One noted case involved the use of Swiss intermediaries to funnel money to regimes facing extensive sanctions, thus undermining global security efforts.

Efforts to Unmask the Secret Networks

Global Pressure and Transparency Initiatives

International bodies like the Financial Action Task Force (FATF), OECD, and G20 have pressured Switzerland to reform banking secrecy.

Switzerland has signed agreements to participate in Automatic Exchange of Information (AEOI), sharing bank information with foreign tax authorities starting in 2017. Additionally, the implementation of the Common Reporting Standard (CRS) marks a significant push toward dismantling complete secrecy.

Whistleblowers and Leaks

Leaks such as the "Swiss Leaks" (2015) exposed HSBC’s Geneva branch operations that facilitated widespread tax evasion via secret accounts, sparking international investigations.

Whistleblowers remain crucial allies for investigative journalists and law enforcement unraveling these opaque networks.

Limitations and Resistance

Despite reforms, Swiss banking regulators face inherent tensions between preserving client privacy—an ingrained cultural and economic value—and adhering to international transparency standards.

Many wealth management firms still prioritize confidentiality, employing sophisticated legal tools to uphold discretion even amid evolving global regulations.

The Impact: Why It Matters Globally

Economic Consequences

Secret banking networks undermine efforts to collect fair tax revenues. Tax evasion facilitated by Swiss accounts is estimated to cost governments billions annually, impairing public services and infrastructure development worldwide.

Geopolitical Dimensions

Concealed finances aid kleptocrats and authoritarian regimes, enabling them to entrench power and avoid accountability. This threatens democratic institutions and fuels global inequality.

Ethical and Social Costs

The opacity marginalizes ordinary citizens who adhere to laws while elites exploit hidden channels, exacerbating social dissatisfaction and trust deficits in financial systems.

Conclusion: Towards a More Transparent Financial Future

Switzerland’s secret banking networks and hidden transactions embody a complex challenge intertwined with history, sovereignty, and global finance. While reforms have chipped away at the aura of invincibility surrounding Swiss banking secrecy, significant work remains.

Eradicating illicit financial flows requires international cooperation, stricter enforcement, and public vigilance. Striking a balance between privacy rights and transparency is vital for equitable and sustainable global economic governance.

Informed citizens and policymakers must persist in shedding light on these clandestine networks, promoting integrity in finance, and ensuring that banking secrecy no longer shields wrongdoing but protects legitimate privacy.

The Swiss example reminds us: in the quest for justice and transparency, no fortress remains impregnable forever.

Rate the Post

User Reviews

Popular Posts