Impact of Economic Indicators on Investments

6 min read Explore how economic indicators influence investment decisions and market trends, offering valuable insights for investors. (0 Reviews)

Impact of Economic Indicators on Investments

Economic indicators play a pivotal role in shaping the financial landscape and informing investment decisions. By understanding these indicators, investors can better navigate the complexities of the market, making informed choices that align with their financial goals. This article explores various economic indicators, their impact on investment strategies, and practical insights to enhance investment decision-making.

What Are Economic Indicators?

Economic indicators are statistical data points that reflect the overall health of an economy. They are crucial for assessing economic performance, helping investors make predictions about market trends and potential investment opportunities. There are three primary types of economic indicators:

- Leading Indicators: These indicators predict future economic activity. Examples include stock market performance, new housing starts, and consumer confidence indices. Investors often look to leading indicators to forecast market trends.

- Lagging Indicators: These indicators provide insights based on historical data. Examples include unemployment rates and GDP growth. While they confirm trends, they do not predict future movements, which makes them less useful for timing investments.

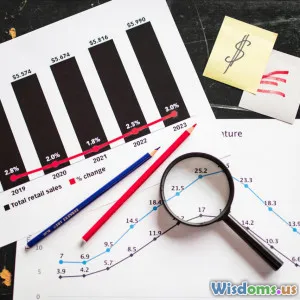

- Coincident Indicators: These indicators occur simultaneously with the economic cycle. They include measures like retail sales and industrial production, which help investors gauge current economic conditions.

Key Economic Indicators and Their Impact on Investments

1. Gross Domestic Product (GDP)

GDP is one of the most critical indicators of economic health, representing the total value of all goods and services produced over a specific time. A growing GDP typically signals a healthy economy, encouraging investor confidence and leading to increased investments in stocks and real estate. Conversely, a declining GDP may prompt investors to withdraw from the market.

2. Unemployment Rate

The unemployment rate indicates the percentage of the labor force that is unemployed but actively seeking work. High unemployment levels can lead to reduced consumer spending, which negatively impacts businesses and, in turn, their stock prices. Investors often use unemployment data to assess market sentiment and economic stability.

3. Consumer Price Index (CPI)

CPI measures the average change over time in the prices paid by urban consumers for a basket of consumer goods and services. It is a key indicator of inflation. Rising inflation can erode purchasing power and lead to higher interest rates, impacting investment returns. Investors need to be aware of CPI trends to adjust their portfolios accordingly.

4. Interest Rates

Set by central banks, interest rates significantly influence investment decisions. Lower interest rates often stimulate borrowing and investing, leading to higher asset prices. Conversely, high interest rates can slow down economic growth and depress market performance. Investors should monitor interest rate trends to adjust their investment strategies.

5. Stock Market Performance

The performance of stock indices like the S&P 500 or Dow Jones Industrial Average serves as a barometer for investor sentiment. Rising stock prices generally indicate optimism about the economy, while falling prices may reflect concerns about future economic performance. Investors often analyze stock market trends alongside economic indicators to make informed decisions.

Practical Tips for Investors

- Stay Informed: Regularly follow economic reports and news to understand how different indicators are moving. Websites like the Bureau of Economic Analysis and financial news outlets provide valuable data.

- Diversify: Use economic indicators to inform diversification strategies. For example, if inflation is rising, consider investing in assets that traditionally perform well during inflationary periods, like commodities or real estate.

- Use Technical Analysis: Combine economic indicators with technical analysis to enhance timing on entry and exit points for investments.

- Consult Financial Advisors: If uncertain about interpreting economic indicators, consider consulting with a financial advisor who can provide expert insights tailored to your investment goals.

Conclusion

Understanding the impact of economic indicators on investments is essential for making informed financial decisions. By keeping an eye on leading, lagging, and coincident indicators, investors can better navigate the market's complexities. Whether it's GDP growth, unemployment rates, or inflation, these indicators provide critical insights that can help shape an effective investment strategy. As economic conditions evolve, staying informed and adaptable will empower investors to seize opportunities and mitigate risks in their investment journey.

Rate the Post

User Reviews

Popular Posts