Investment Opportunities in a Downturn

6 min read Explore strategic investment opportunities that arise during economic downturns, ensuring financial growth even in challenging times. (0 Reviews)

Investment Opportunities in a Downturn

Economic downturns can be daunting for investors, but they also present unique opportunities for those willing to look beyond the immediate panic. While many investors retreat during challenging times, savvy ones recognize that market dips often lead to profitable ventures. This article explores various investment opportunities that arise during downturns, providing insights and strategies to help you navigate these turbulent waters.

Understanding Economic Downturns

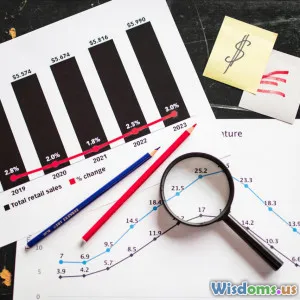

An economic downturn is defined as a decline in economic activity, typically measured by a decrease in GDP. These downturns can result from various factors, including financial crises, geopolitical events, or global pandemics. The impact of such downturns is felt across various sectors, leading to lower consumer spending, reduced business profits, and, ultimately, stock market declines.

Historical Context

Historically, economic downturns have led to significant market corrections. For instance, during the 2008 financial crisis, the stock market plummeted, but it also created opportunities for investors who were willing to buy undervalued assets. Similarly, the COVID-19 pandemic saw a sharp decline in stock prices, yet many investors capitalized on the low prices of fundamentally strong companies.

Identifying Investment Opportunities

When the market is down, discerning which assets offer potential for growth is crucial. Here are some lucrative avenues to consider:

1. Undervalued Stocks

During market downturns, many stocks become undervalued as panic selling ensues. Investors can look for companies with strong fundamentals that are temporarily undervalued. For example, industries such as technology and consumer goods may present opportunities to acquire shares at a lower price.

2. Defensive Stocks

Defensive stocks, which are shares in companies that remain stable regardless of the market conditions, can be a safe haven during downturns. These typically include utilities, healthcare, and consumer staples. For instance, during the 2020 pandemic, companies like Procter & Gamble and Johnson & Johnson maintained solid performance due to their essential products.

3. Real Estate Investments

Economic downturns can lead to lower property prices, providing opportunities for real estate investors to acquire properties at a discount. Investing in rental properties can provide a steady income stream, while purchasing undervalued properties can lead to significant long-term capital appreciation.

4. Bonds and Fixed-Income Securities

When stocks are volatile, many investors turn to bonds and other fixed-income securities. Government bonds, in particular, are considered safe investments during downturns. They provide a predictable income stream and are less risky compared to equities.

5. Alternative Investments

Downturns can also encourage investors to explore alternative assets such as commodities, private equity, or hedge funds. These investments can provide diversification and potentially higher returns, especially when traditional markets are underperforming.

6. Startups and Emerging Markets

While investing in startups may seem risky during a downturn, it can also offer high rewards. Many successful companies, like Airbnb and Uber, emerged during economic recessions. Additionally, investing in emerging markets can yield significant returns as these economies recover faster.

Strategies for Success

To successfully navigate investment opportunities during a downturn, consider the following strategies:

1. Do Your Research

Conduct thorough research to identify companies and sectors that are undervalued yet have strong fundamentals. Look for companies with low debt levels and solid cash flow.

2. Diversify Your Portfolio

Diversification is key to mitigating risk. Consider spreading your investments across different asset classes and sectors to protect your portfolio from volatility.

3. Stay Calm and Patient

Emotional decision-making can lead to poor investment choices. Maintain a long-term perspective and avoid panic selling. Remember that markets eventually recover.

4. Consult Financial Advisors

If you're unsure about your investment strategy, consider consulting a financial advisor. They can provide personalized advice and help you make informed decisions.

Conclusion

Investment opportunities during economic downturns are abundant for those who are willing to look beyond the immediate challenges. By identifying undervalued stocks, exploring defensive investments, and considering alternative assets, investors can position themselves for long-term success. Remember, downturns are often temporary, and the markets will eventually recover. By taking a strategic and informed approach, you can capitalize on these unique opportunities and build a resilient investment portfolio.

Stay informed, do your research, and embrace the challenges of investing during downturns. The opportunities may be greater than you think.

Rate the Post

User Reviews

Popular Posts