Exposing The Networks Behind Money Laundering In Luxury Real Estate

15 min read Unmask the secretive networks enabling money laundering practices within luxury real estate markets worldwide. (0 Reviews)

Exposing The Networks Behind Money Laundering In Luxury Real Estate

Money LAUNDERING—two words that evoke visions of shadowy figures, hidden transactions, and global cover-ups. Nowhere is this financial sleight of hand more enticing, or problematic, than in the soaring glass and steel cathedrals of luxury real estate. Across major cities—from New York to London, Miami to Vancouver—luxury penthouses, beachfront villas, and skyscraper condos frequently serve as silent partners in some of the world’s most intricate money laundering operations. But how does high-end real estate become a haven for dirty money, and what networks make it all possible?

The Global Appeal of Luxury Real Estate

Luxury real estate is not just a symbol of success or a lifestyle choice; it’s a borderless asset class, capable of retaining and multiplying value across continents. For wealthy individuals or criminal enterprises, the attraction goes beyond aesthetics:

- Stability: Prime properties in global cities like London, Paris, or Manhattan almost always appreciate over time, making them safe havens against economic turmoil.

- Anonymity: Many legal structures make it easy for buyers to conceal their true identities; shell companies and trusts are among the top vehicles.

- Liquidity: High-value real estate can often be flipped easily, quickly converting property back into cash or moving it between entities.

Example: In 2016, a report revealed that a single anonymous shell company held about $200 million worth of Manhattan real estate, with the true ownership masked from public scrutiny.

Unmasking The Actors: Who’s Moving The Money?

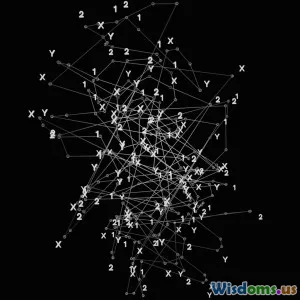

Behind every headline-worthy property investment are networks—a careful choreography of individuals and entities with distinct roles:

1. The "Front" Purchasers and Nominees

Criminals rarely buy property in their own name. Instead, trusted associates—sometimes legitimate-looking businesspeople or relatives—front for the real buyer. In one London case, a house purchased for over £11 million was registered to an offshore firm's nominee director, hiding the oligarch who truly owned it.

2. Real Estate Agents and Law Firms

While many professionals abide by the law, some become inadvertent or complicit contributors, failing to perform due diligence or intentionally ignoring suspicious origins of funds. Spot commissions and exclusive listings become powerful incentives. In Miami, more than 20% of luxury transactions in a single year involved buyers of unknown origin or nationality.

3. Facilitators: Shell Companies, Trusts, LLCs

Layering ownership through opaque jurisdictions (the Cayman Islands, British Virgin Islands, or Delaware are frequent choices) establishes distance between the crime and the asset. Panama Papers leaks illustrated how global elites exploited law firm Mossack Fonseca to set up hundreds of such front companies, channeling illicit funds into high-end real estate with ease.

The Methods: How Dirty Money Gets Clean

Money laundering in real estate typically follows a classic three-stage formula: placement, layering, and integration, but includes property-specific twists.

Stage 1: Placement

Money enters the system via a property purchase, sometimes with large cash payments, complex mortgage arrangements, or even cryptocurrency. For example, in 2022, luxury real estate in Dubai was purchased in Bitcoin by anonymously owned holding companies tied to foreign elites.

Stage 2: Layering

Ownership changes hands—often rapidly—through sales between shell companies in different jurisdictions. Capital improvements, inflated valuations, and phony leases can disguise provenance. Infamously, a bank in Latvia was used to funnel laundered money through over a dozen U.S. property LLCs before funnelling out the ‘cleaned’ cash.

Stage 3: Integration

At this point, the funds “emerge” as seemingly legitimate assets. The property may be resold, rented to related entities, or mortgaged—each transaction giving an air of legitimacy. A notable Canadian case involved a luxury Toronto condo bought, improved, and sold at a profit, with each layer adding to the origin story’s complexity.

Why Luxury Real Estate? Unique Advantages For Criminal Networks

While criminal proceeds might find sanctuary in art, gold, or crypto, luxury real estate offers unparalleled benefits.

- High Value Per Transaction: Enormous sums can be laundered in a single purchase. In London’s upscale Knightsbridge, a Saudi prince snapped up a home for £105 million—all via an intricate web of offshore companies.

- Low Scrutiny in Certain Markets: Until recently, U.S. authorities performed little oversight of real estate purchases. Similar loopholes persist in Canada, Spain, and parts of Asia.

- Physical Security: Unlike digital assets, a mansion or penthouse can’t simply vanish. Even if frozen, ongoing legal manoeuvres allow criminals to extract some value via rents or by securing mortgages.

Regulatory Gaps and Policy Failures

Despite international norms like the Financial Action Task Force (FATF) recommendations, enforcement is patchy and riddled with inconsistencies.

Weak Due Diligence

Many countries do not require real estate agents or lawyers to report suspicious transactions—a glaring loophole. In Canada, luxury realtors “volunteered” anti-money laundering compliance, creating vast inconsistencies in implementation.

Ownership Transparency

Real ownership disclosure varies wildly. Countries like the UK now mandate register entries for foreign owners, but many regions lack such mechanisms. The U.S. Geographic Targeting Order (GTO) pilot—launched in Miami and Manhattan—requires title companies to reveal beneficial owners, but only for cash transactions above certain thresholds and only in certain markets.

Enforcement Challenges

Enforcement is often underfunded or undermined by lobbying. An investigation by Transparency International found that over £4.4 billion worth of suspicious funds was poured into UK property—with only a handful of successful prosecutions over the past decade.

Digital Disruptions: Cryptocurrency And Virtual Transactions

State-of-the-art criminals increasingly harness cryptocurrency—using pseudonymous addresses, decentralized exchanges, and intricate privacy vectors. Entire properties have been bought with Bitcoin or Ethereum, sidestepping traditional banks’ anti-money laundering screens. Dubai and Miami—both high-profile crypto hubs—have seen surges in such activity, spurred by patchy regulations and the allure of swift, untraceable deals.

Yet, law enforcement is catching up. Large cryptocurrency-to-real-estate cases now prompt automatic reviews. The 2021 arrest of a cybercriminal ring in Singapore uncovered real estate assets worth SGD 100 million, purchased largely via crypto.

Efforts To Combat Real Estate Money Laundering

The fight is far from one-sided. Governments, financial bodies, and investigative journalists are employing new tactics:

- Beneficial Ownership Registers: Places like the UK, EU, and some U.S. cities have launched open owner registries to shine light on shell company buyers.

- Technological Monitoring Tools: Startups use AI and blockchain for pattern recognition, tracing suspicious flows and identifying related parties.

- International Coordination: Recent FATF recommendations require cross-border data sharing for complex or high-risk deals.

- Journalism and Whistleblowing: The Panama Papers, FinCEN Files, and OCCRP investigations regularly uncover hidden property empires, prompting new waves of regulatory scrutiny.

Example: In 2020, the U.S. passed the Corporate Transparency Act, requiring most corporations and LLCs to disclose their beneficial owners to the Treasury’s FinCEN bureau.

How The Real Estate Industry Can Respond

To make meaningful progress, the industry must go beyond minimal legal requirements. Here’s how developers, brokers, and professionals can safeguard their markets:

- Rigorous Client Verification: Implement Know Your Customer (KYC) checks, even if not locally mandated.

- Enhanced Training: Regular staff education on red flags—such as atypical payment methods, rapid resales, and inconsistent paperwork.

- Collborate With Law Enforcement: Establish communication channels for automatic flagging of questionable deals.

- Embrace Tech Solutions: Leverage AI-powered transaction monitoring and beneficial owner tracing platforms.

- Support Regulatory Change: Advocate for comprehensive, robust standards across national and international jurisdictions.

If the industry hesitates, it risks reputational and financial fallout—much as happened when Swiss banks eventually faced global pressure to unveil secret accounts.

Real-World Cases: Lessons From The Headlines

The Azerbaijani Laundromat

A network of Azerbaijani oligarchs laundered billions through shell companies buying British and French luxury real estate. Investigations exposed lavish shopping sprees, multi-million dollar mansions, and luxury apartments—all traced to embezzled public funds.

Vancouver’s "Snow Washing"

Canada’s western cities saw an influx of foreign capital during the 2010s, with mansions snapped up by buyers using blind trusts and nominee directors. A 2023 probe estimated $5 billion had been “snow-washed” through local markets, driving up housing costs for ordinary residents.

South Florida Tomes

Miami’s coastal condos have become renowned for hosting offshore fortunes. A slew of federal indictments in 2019 revealed schemes connecting Venezuelan kleptocrats, Miami shell companies, and law firms. The value: more than $450 million in seized or frozen assets since 2015.

The Hidden Costs: Societal and Economic Impacts

Money laundering is not simply an elitist crime with abstract victims; it warps cities at their core:

- Housing Affordability: As dirty money pours in, prices balloon—forcing locals out of the market. New York’s Billionaires Row has a 60% vacancy rate, with many condos owned by shell corporations.

- Undermined Trust: Law-abiding citizens lose faith in property markets when they suspect widespread abuse, sapping confidence in government and financial institutions.

- Erosion of Urban Identity: Trophy properties sit empty much of the year, transforming vibrant neighborhoods into hollow investment vehicles.

What You'll See Next: Trends Shaping the Fight

The collision between real estate and illicit finance is evolving rapidly. Expect to see:

- Broader Disclosure Laws: The EU has pledged to expand register requirements to all member states by 2026.

- AI Forensics: Firms are deploying AI-powered title search engines, matching property deeds against transaction databases for anomaly detection.

- Crossborder Task Forces: New inter-agency task forces, like CERBERUS in the EU, pool resources to chase money around the world.

- Cryptocurrency Regulation: Digital asset exchanges are being drafted into FATF’s “Travel Rule,” demanding owner details on real estate-connected crypto deals.

As homes become the ultimate status signal, they also stand as beacons—sometimes for investment, sometimes for illicit activity. Through technology, regulation, and civic vigilance, pulling back the curtain on luxury real estate networks may, at last, become a real possibility.

Rate the Post

User Reviews

Popular Posts