How to Analyze Market Trends Effectively

6 min read Master the art of market trend analysis with practical tips and insights to boost your business and investment success. (0 Reviews)

How to Analyze Market Trends Effectively

Analyzing market trends is an essential skill for anyone involved in business and investing. Understanding these trends allows you to make informed decisions, anticipate market movements, and ultimately achieve greater success. Whether you are a seasoned investor or a budding entrepreneur, mastering the art of market trend analysis can significantly impact your outcomes. In this article, we will explore effective strategies and tools to analyze market trends, ensuring you stay ahead in the competitive landscape.

Understanding Market Trends

Market trends refer to the general direction in which a market is moving over a period of time. These trends can be upward (bullish), downward (bearish), or sideways (neutral). Recognizing these patterns helps businesses and investors align their strategies with market movements.

Types of Market Trends

- Short-term trends: These trends last from a few days to several weeks. They are often influenced by news events or seasonal factors.

- Medium-term trends: Lasting from several weeks to months, these trends can be driven by broader economic factors or market sentiment.

- Long-term trends: These last for several months to years and are often tied to fundamental changes in the economy or industry.

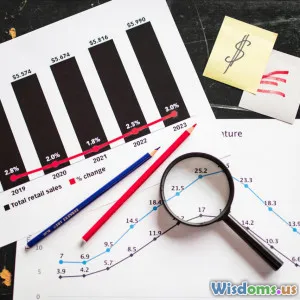

Steps to Analyze Market Trends

1. Gather Relevant Data

Before analyzing trends, you need to collect data. Utilize various sources, including:

- Market Reports: Industry reports provide insights into market dynamics, consumer behavior, and competitive landscapes.

- Financial News: Stay updated with financial news platforms to catch market-moving events.

- Social Media & Forums: Platforms like Twitter and Reddit can offer real-time sentiment and discussions among market participants.

2. Use Analytical Tools

Invest in tools that aid in trend analysis. Some popular ones include:

- Charting Software: Software like TradingView or MetaTrader can help visualize trends through charts.

- Statistical Analysis Tools: R or Python libraries can assist in performing complex analyses and generating forecasts.

- Market Research Tools: Tools like Statista and IBISWorld provide extensive data and insights on various industries.

3. Identify Patterns and Signals

Recognize patterns that indicate potential trends:

- Moving Averages: These smooth out price data to help identify the direction of the trend.

- Trend Lines: Drawing trend lines on charts can visually represent the market's direction.

- Candlestick Patterns: Understanding candlestick patterns can signal potential reversals or continuations in the market.

4. Monitor Economic Indicators

Economic indicators can provide context to market trends. Key indicators to watch include:

- GDP Growth: A growing economy typically leads to bullish trends.

- Unemployment Rates: High unemployment can indicate economic weakness.

- Consumer Confidence Index (CCI): A high CCI often correlates with increased spending, influencing market trends.

5. Stay Agile and Adapt

Markets are dynamic, and trends can shift quickly. Stay flexible in your approach:

- Review Your Analysis Regularly: Periodically reassess your findings and be ready to pivot your strategy if necessary.

- Set Alerts: Use tools that notify you of significant market movements or news.

Practical Application: Case Study

Let’s consider a practical example: Suppose you’re analyzing the tech sector. By gathering data from industry reports, you notice an uptick in demand for cloud computing services. Using charting software, you identify an upward trend in leading companies' stock prices. You also monitor economic indicators, which show increasing consumer spending in technology. From this analysis, you decide to invest in a promising cloud computing firm, leveraging your insights to maximize your returns.

Conclusion

Analyzing market trends is not just about looking at numbers; it’s about interpreting that data to make informed decisions. By employing a systematic approach that includes data gathering, utilizing analytical tools, recognizing patterns, monitoring economic indicators, and staying adaptable, you can significantly enhance your ability to navigate the markets. With practice and dedication, you will be well-equipped to identify and leverage market trends effectively, paving the way for your business and investment success.

Rate the Post

User Reviews

Popular Posts