Why ESG Investing Might Outperform in the Next Decade

15 min read Discover why ESG investing could outperform traditional strategies over the next decade, driven by shifting regulations, consumer demand, and financial resilience. (0 Reviews)

Why ESG Investing Might Outperform in the Next Decade

As the world pivots toward sustainability, a profound transformation is shaking the foundations of the investment landscape. Public interest, regulatory momentum, and shifting economic realities are fueling strategies that prioritize not just profits, but also people and the planet. ESG investing—screening investments for Environmental, Social, and Governance qualities—is more than just a trend. It’s increasingly recognized as a path to superior, resilient long-term performance. Here’s why the next decade could be the golden era for ESG-driven portfolios, and how forward-thinking investors stand to benefit.

What Defines ESG? Understanding Its Three Pillars

ESG stands for Environmental, Social, and Governance, three central factors in measuring the sustainability and ethical impact of an investment in a company or business.

-

Environmental: How a company performs as a steward of the natural world. This includes its carbon footprint, waste management, resource use, and impact on biodiversity. For example, renewable energy firms like Ørsted have made dramatic transformations from fossil fuels to wind power, earning higher ESG ratings and investment flows.

-

Social: Examines how a company manages relationships with employees, suppliers, customers, and communities. Starbucks, for instance, has implemented fair trade sourcing and extensive employee benefits programs, setting industry standards in the process.

-

Governance: Relates to a company’s leadership, executive pay, audits, internal controls, and shareholder rights. Firms like Unilever are renowned for their board diversity and transparent governance structures, correlating with investor trust and share price stability.

Understanding these pillars helps investors look beyond quarterly earnings, focusing instead on organizations prepared for future risks and opportunities.

The Evidence: Does ESG Outperform Traditional Investing?

Skeptics once dismissed ESG as sacrificing returns for values. Recent research tells a different story. In a groundbreaking 2021 study, Morgan Stanley found that sustainable funds delivered equal—or sometimes greater—returns than traditional peers, even when markets tumbled during crises like the COVID-19 pandemic.

Key statistics:

- In the tumultuous markets of 2020, 24 out of 26 ESG-focused index funds outperformed their conventional benchmarks, according to S&P Global.

- Morningstar’s 2023 report showed that 62% of sustainable funds outperformed over a five-year period, disproving the notion of an ESG performance penalty.

- Europe’s largest sustainable equity funds, such as the UBS (Lux) Equity SICAV – Global Impact Fund, posted annualized returns exceeding many mainstream global equity funds over the past decade.

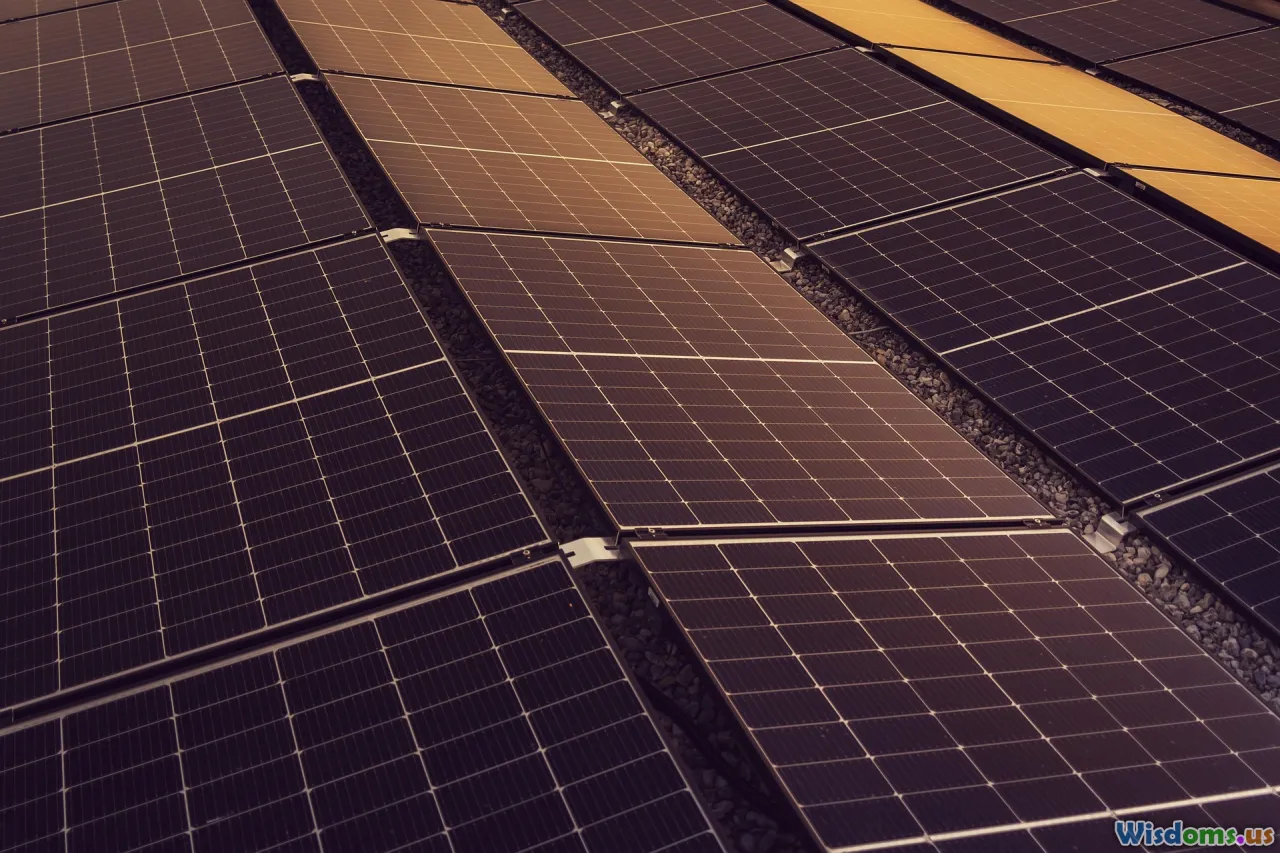

Case in point: NextEra Energy—a leader in wind and solar—outpaced the S&P 500 between 2010 and 2020 by more than 250%, proving that green priorities and growth can go hand in hand.

Why ESG-Driven Companies Are Positioned for Resilience

The next decade will bring societal and environmental shocks: climate disruptions, talent shortages, increased stakeholder activism, and new regulations. ESG-focused firms tend to outperform because they’re built for this kind of resilience.

1. Climate Readiness: Companies already transitioning to low-carbon operations, like Tesla or Ørsted, face less regulatory and reputational risk as governments roll out carbon pricing and emissions caps.

2. Supply Chain Stability: Social and environmental scrutiny pushes firms toward ethical supply chains. Nike, after substantial reputational crises in the 1990s, overhauled their practices, integrating responsible sourcing and transparency initiatives. Its subsequent brand recovery helped future-proof its business against public backlash.

3. Governance as a Shock Absorber: Strong governance means better crises management and oversight. Consider how Johnson & Johnson’s swift, transparent handling of product recalls allowed it to weather storms with less damage to shareholder value than competitors with opaque cultures.

These advantages add up, particularly in an age defined by Black Swan events—from global pandemics to resource shocks.

Regulatory Momentum: Turning ESG from Option to Obligation

Regulators, especially in European markets, are increasingly mandating ESG disclosures.

- EU Sustainable Finance Disclosure Regulation (SFDR): Rolled out in 2021, SFDR requires fund managers to publish how sustainability risks are integrated into investment decisions.

- US SEC Climate Disclosure Proposal: The Securities and Exchange Commission (SEC) is moving towards requiring US-listed companies to provide clear climate risk disclosures in financial filings.

Japan's stock exchanges are also tightening sustainability-reporting rules, driving corporations like Toyota to accelerate transparency and emissions cuts.

For investors, compliance reduces information asymmetry: It’s easier to assess which companies are greenwashing and which are future-ready. As these regulations spread globally, ESG integration transitions from branding edge to economic imperative.

The Generational Wealth Shift Spurring ESG Demand

An estimated $84 trillion is expected to change hands in the U.S. alone as Baby Boomers pass wealth to Millennials and Gen Z over the next two decades.

Why does this matter? These younger investors rank sustainability and social impact as top investment priorities according to a 2023 Morgan Stanley Institute for Sustainable Investing survey—85% of individual investors and 95% of Millennials expressed interest in sustainable investing.

Digital investment platforms like Robinhood and Acorns now feature sustainable investing tools and filters as standard, allowing novice and veteran alike to back what aligns with their values. Asset managers like BlackRock and Vanguard report record inflows into ESG funds. This rising tide of capital will likely accelerate the performance and availability of ESG vehicles.

Technology and Data: Fueling Smart ESG Investment

Fears around ESG ‘greenwashing’—when companies exaggerate their eco-friendly credentials—once hampered the sector. Today, sophisticated analytics and AI systems track thousands of non-financial data points—from satellite-measured carbon emissions to algorithmic sentiment analysis of media coverage.

Fintech innovators like Sustainalytics, MSCI, and Clarity AI provide ESG ratings open for investor scrutiny. Firms can be benchmarked and held accountable at the click of a button.

This level of clarity allows investors to:

- Spot genuinely sustainable corporations (and avoid greenwashed imposters)

- Calculate ESG risk exposures as easily as financial ones

- Perform thematic searches: for instance, tracking portfolios that address specific Sustainable Development Goals (SDGs), such as gender equality or zero hunger

As ESG data becomes integrated into mainstream financial models, ESG investing becomes less about gut feeling, more about evidence-based returns.

Market Risks: Why Ignoring ESG Exposes Investors

Neglecting ESG factors no longer carries zero cost. Outdated strategies risk being left holding the bag as industries transform and regulations tighten.

Stranded Assets: Fossil-fuel companies, once market titans, now face existential risk. As decarbonization accelerates, coal and oil assets risk becoming ‘stranded’—essentially obsolete—with BlackRock estimating $900 billion in potential stranded fossil fuel infrastructure globally.

Reputational Damage: Firms that falter on social or governance standards (such as Volkswagen’s emissions scandal or Wells Fargo’s unethical sales practices) have lost billions in market capitalization and consumer trust. Investors feel the sting directly in share price tumbles and volatility spikes.

By integrating ESG, individuals and institutions hedge against the growing list of non-financial risks reshaping the global economy.

How to Build an ESG-Oriented Portfolio: Actionable Steps

-

Set Clear Objectives: Decide whether your focus is broad ESG exposure or targeted impact (for example, renewable energy, gender diversity, or community development).

-

Choose the Right Vehicles: Consider ETFs like the iShares MSCI KLD 400 Social ETF (DSI) or mutual funds like Parnassus Core Equity Fund. Many robo-advisors now offer ESG strategies as a default selection.

-

Look Under the Hood: Don’t just accept the ESG label. Review ratings from multiple agencies (e.g., MSCI, Sustainalytics), and scan fund holdings for true ESG leaders—not just brands.

-

Balance and Diversify: Combine global and sector-specific ESG funds, mixing equities with green bonds (like the World Bank’s Sustainable Development Bonds) for a diversified impact.

-

Monitor and Engage: Keep tabs on your investments’ impact and progress. Many platforms now allow shareholders to vote proxies on ESG matters, amplifying your voice.

-

Stay Updated: ESG is evolving rapidly. Subscribe to newsletters (such as Morningstar’s Sustainable Investing), attend webinars, and review fund disclosures annually.

Portfolio-building with ESG at the core is not just about doing good; it’s a savvy risk-mitigation and alpha-hunting approach for the new financial era.

Fast-Moving Sectors: Where ESG Could Outpace Most

Some industries are especially primed for ESG-led growth in the 2020s:

- Renewable Energy: Solar, wind, energy storage, and supporting infrastructure (e.g., Enphase, Siemens Gamesa).

- Electric Mobility: Electric vehicles (Tesla, BYD), charging networks, and battery recycling technologies.

- Sustainable Agriculture: Companies like Beyond Meat and Deere & Co. are innovating for climate resilience and global food security.

- Healthcare Access: Firms working on affordable vaccines or telemedicine platforms ( Teladoc). Health equity is rising as an investment theme.

- Green Real Estate: Energy-efficient buildings and REITs specializing in green properties (Prologis).

Investors targeting these high-growth, sustainable sectors may capture outsized returns compared to legacy industries weighed down by transition risk and shifting consumer attitudes.

The Road Ahead: Vision, Innovation, and Robust Performance

As ESG maturity accelerates, companies unwilling or unable to adapt risk being marginalized by capital flows, legislation, and public opinion. Conversely, forward-thinking enterprises—those weaving carbon-neutral operations, diversity targets, and rock-solid governance into their DNA—are already commanding premium valuations and outperform the laggards.

For investors, ESG is no longer a moral sideline or a branding exercise. The next decade’s winners will be those who recognize that sustainability is a financial priority and who use data and due diligence to separate the leaders from the lemmings.

Astute allocators will continue to blend ethics and economics, unlocking the twin engines of profit and purpose. If the past ten years were about introducing ESG, the next will be about outperforming with it. For portfolios eager to capture growth and stability, the future is already arriving—and it's unequivocally sustainable.

Rate the Post

User Reviews

Popular Posts