Actively Managed Funds Are Staging an Unexpected Comeback

9 min read Explore the surprising resurgence of actively managed funds amidst evolving market dynamics and investor preferences. (0 Reviews)

Actively Managed Funds Are Staging an Unexpected Comeback

Investment landscapes are in constant flux, driven by shifting market conditions, technological evolution, and changing investor mindsets. For years, passive investing reigned supreme, with index-tracking funds outpacing their actively managed rivals. However, in a development that has caught many by surprise, actively managed funds are staging a notable comeback. This revival raises an important question: what factors are propelling active management back into favor?

In this article, we explore the dynamics behind this unexpected resurgence. We will dissect the historical context, analyze market catalysts, underscore performance trends, and evaluate what this means for investors moving forward.

The Rise, Fall, and Revival of Actively Managed Funds

Historical Context: The Dominance of Active Management

Traditionally, active fund management dominated asset management industries worldwide. Skilled fund managers aimed to outperform market indices through research-driven stock picking and market timing. The appeal was clear: beat the market and deliver superior returns.

However, this model often struggled to deliver on its promise consistently. Studies such as the SPIVA (S&P Indices Versus Active) report showed a large majority of active funds failed to beat comparable passive indexes over longer periods. These findings eroded investor confidence, fueling the meteoric rise of passive investing.

Passive Investing’s Surge and Active Funds’ Decline

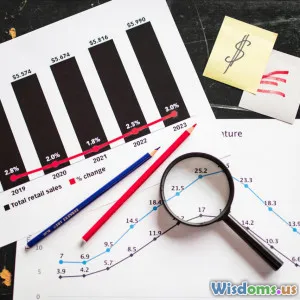

Over the past two decades, passive funds – exchange-traded funds (ETFs) and index funds – have gained broad popularity. They offer lower fees, transparency, and generally consistent market returns, making them highly attractive, especially for retail investors. In the US alone, assets in passive funds ballooned from approximately $1 trillion in 2007 to over $9 trillion by 2023.

This surge compressed fees across the board and applied pressure on active managers to justify their costs and complexity. Consequently, actively managed funds saw outflows and lagged in popularity.

Signs of a Shift: Early Indicators of Active Return

Despite the dominance of indexing, recent years have revealed cracks in the passive narrative. Volatile market conditions, geopolitical uncertainties, and sector rotations exposed passive funds’ inherent limitations, such as inflexibility and concentration risks.

In 2022 and 2023, actively managed funds began posting stronger relative performance in certain sectors, such as value investing, small-cap stocks, and niche thematic strategies. Surgeons precision and opportunistic allocation gave some active funds an edge.

Drivers of the Active Fund Comeback

Market Volatility and Complexity

One core reason behind this resurgence is increased market volatility. Events like the pandemic-induced crash, inflationary pressures, geopolitical tensions, and interest rate shifts have upset markets unpredictably.

Passive funds replicate indexes regardless of market conditions, resulting in buying high and selling low in some scenarios. Conversely, active managers can nimble navigate through turbulence, reducing exposure to overpriced sectors or reallocating into undervalued opportunities.

For example, in 2022, actively managed bond funds outperformed passive bond ETFs by an average margin of 1.7%, largely attributed to strategic duration management and credit selection amid rising yields.

Investor Desire for Alpha Over Beta

Investors seeking "alpha"—returns above the market—are returning to active funds for tailored opportunities. High-net-worth individuals and institutional investors especially value diversification beyond broad market bets.

Bill Johnson, CFO at a leading family office, commented in 2023: "After the volatility of recent years, we have been emphasizing active strategies that can respond to shifting market themes instead of blindly tracking indices."

This renewed appetite is encouraging fund managers to leverage proprietary research, alternative data, and artificial intelligence to identify mispriced assets.

Evolution in Active Management Techniques

The evolution of technology and data analytics has modernized active management. Leveraging AI-driven screening, big data, and machine learning algorithms allows active fund managers to augment traditional financial analysis with cutting-edge tools.

Moreover, environmental, social, and governance (ESG) considerations are heavily integrated into active strategies. This approach appeals to values-driven investors seeking impact alongside financial gains, a niche less suited for pure passive funds.

Fee Adjustments and Performance Improvements

In response to passive competition, many asset managers have redesigned fee structures to become more performance-aligned, increasing investor attraction. By offering lower base fees combined with performance-based fees, active funds are better positioned to justify their costs.

Simultaneously, some active funds have improved their track record. According to Morningstar data, the 3-year average outperformance rate of US equity active funds versus their benchmarks rose from 24% in 2020 to 38% by early 2024.

Examples of Active Fund Comebacks

Small-Cap Value Funds

Small-cap value stocks historically suffer from under-coverage and volatility, setting fertile grounds for skilled active managers. Funds like the Small-Cap Opportunities Fund outperformed the Russell 2000 Value Index by nearly 5% annually during the 2021–2023 stretch, riding on selective stock picks in undervalued sectors such as industrials and financials.

Thematic and Sector-Specific Funds

Focused active funds exploiting themes such as green energy transition, AI innovation, or healthcare disruption have seen remarkable gains. For instance, the AI Innovators Fund returned 22% in 2023, outpacing the broader technology sector’s 14%, thanks to active selection of pioneering startups and mid-caps.

Fixed Income Strategies

As interest rates rose, actively managed fixed income funds navigated credit risk and duration exposure better than broad bond ETFs. The Dynamic Fixed Income Fund minimized losses by shifting allocations from long-duration government bonds to short-duration corporate credit, outperforming benchmarks by over 3% in 2022.

What This Means for Investors

A Balanced Approach is Key

The active fund comeback underscores that neither passive nor active strategies are outright winners universally. Market conditions dictate the relative merits of each. Combining both in portfolios may provide the diversification of risk and capture of opportunity.

Perform Diligence and Fee Scrutiny

Investors should conduct rigorous due diligence, focusing on a manager's track record during volatile periods and their fee structures. Understanding the investment philosophy and adaptability to changing markets is critical.

Long-Term Perspective and Flexibility

Active funds may outperform during turbulence but can lag in prolonged bull runs dominated by a few mega-cap stocks. A long-term outlook and willingness to rebalance enhance outcomes.

Conclusion

The rise of passive investing undeniably shaped modern portfolio management profoundly. Yet, the recent revival of actively managed funds reveals the nuanced reality of investment strategies. In increasingly complex and uncertain markets, active management's flexibility, expertise, and innovation regain relevance.

Investors should remain open-minded, leveraging active funds strategically alongside passive vehicles to adapt to evolving market landscapes. As industry pioneers innovate and refine active techniques, this comeback story is likely not a fleeting trend but an essential recalibration in asset management.

By understanding these dynamics, investors can confidently navigate their financial futures and harness the best of both worlds.

Rate the Post

User Reviews

Popular Posts