Business Intelligence vs Data Mining Which Boosts ROI Faster

11 min read Explore how Business Intelligence and Data Mining impact ROI and discover which accelerates returns faster with real-world insights and expert analysis. (0 Reviews)

Business Intelligence vs Data Mining: Which Boosts ROI Faster?

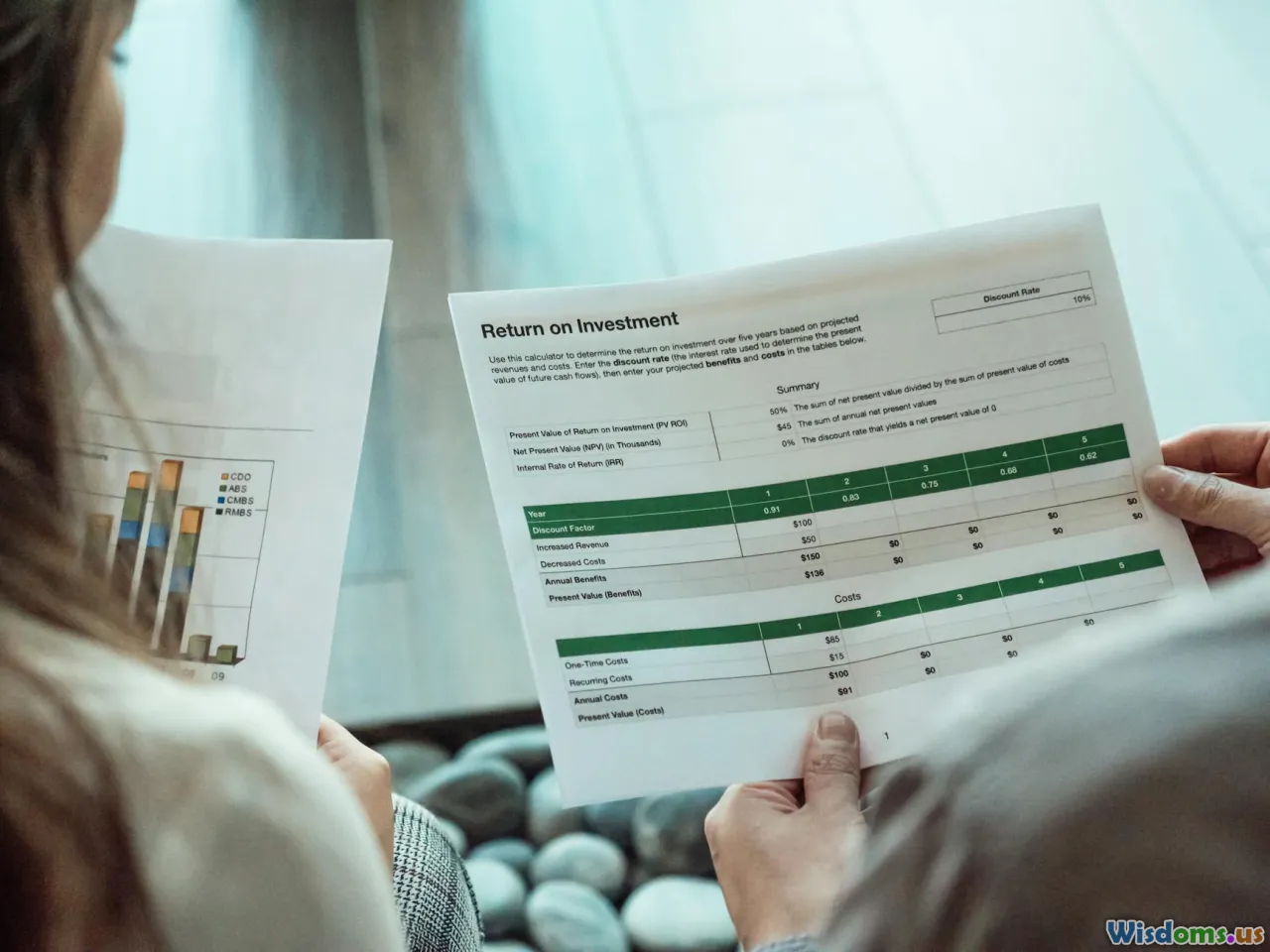

In today's fiercely competitive business environment, leveraging data effectively can be the difference between stagnation and soaring profitability. Two prominent approaches often deployed to extract value from data are Business Intelligence (BI) and Data Mining. While both utilize data to improve decision-making, they serve different strategic purposes and offer distinct paths to enhancing Return on Investment (ROI).

Introduction: The Revenue Race Between BI and Data Mining

Imagine two sprinters standing at the starting line - Intelligence and Mining. Both aim for the same finish line: increased ROI, but their racing styles differ dramatically. Business leaders often ask, "Which strategy can deliver a faster boost to ROI?" Is it the broad-spectrum, dashboard-driven insights of Business Intelligence or the deep, pattern-exploring prowess of Data Mining?

This article delves deep into both disciplines to unpack how each affects ROI, supported by real-world examples, industry data, and the practical nuances you should consider when investing your data resources.

Understanding Business Intelligence and Data Mining

What is Business Intelligence?

Business Intelligence refers to the technologies, practices, and applications used to collect, integrate, analyze, and present business information. BI systems empower decision-makers with historical and current data through reports, dashboards, and interactive visualization tools.

Example: A retail chain uses BI dashboards daily to monitor sales by region, inventory levels, and customer satisfaction scores, enabling managers to spot trends and adjust strategies promptly.

What is Data Mining?

Data Mining employs advanced statistical techniques, machine learning algorithms, and database systems to identify hidden patterns and correlations within large datasets. Unlike BI’s descriptive approach, Data Mining is more predictive and exploratory.

Example: An e-commerce company uses data mining to uncover purchasing patterns, such as combinations of products frequently bought together, informing cross-selling strategies.

Key Differences at a Glance

| Aspect | Business Intelligence | Data Mining |

|---|---|---|

| Purpose | Reporting, monitoring, descriptive analytics | Pattern discovery, predictive analytics |

| Data Focus | Structured, historical data | Large, complex datasets (structured/unstructured) |

| Outcome | Insights on past and current performance | Future trends and behavior prediction |

| User Base | Business managers, analysts | Data scientists, analysts with specialized skills |

Which One Boosts ROI Faster? A Tactical and Strategic Analysis

Speed of Insights and ROI Impact

BI delivers fast-access insights by converting existing data into digestible reports. Organizations often see immediate benefits like better inventory control, reduced overhead, and improved customer experience.

For instance, a 2019 survey by Dresner Advisory Services found that 53% of companies implementing BI experienced cost reduction within the first six months, directly impacting ROI rapidly.

Conversely, Data Mining generally requires a more extended setup period—collecting vast datasets, building models, and validating results. This upfront investment can delay ROI but often uncovers deeper opportunities.

Depth and Magnitude of ROI Boost

While BI’s effects are quicker, they tend to be incremental, focusing on operational efficiency and performance monitoring. On the other hand, Data Mining can reveal novel, revenue-generating strategies—such as identifying untapped customer segments or detecting fraud patterns—which, though slower, may result in substantial, sustainable ROI increases.

Example:

-

Netflix utilizes Data Mining algorithms to analyze viewing patterns, enabling personalized recommendations. This approach has been pivotal in increasing user engagement and reducing churn, resulting in significant long-term revenue growth.

-

Meanwhile, Amazon leverages BI dashboards for real-time inventory management and logistics optimization, yielding swift operational gains.

Cost Considerations

BI tools have become more accessible and user-friendly, often requiring less specialized expertise. This ease can speed deployment and ROI realization.

Data Mining requires skilled data scientists and may involve more significant investments in infrastructure and algorithm development, which might delay initial returns but offer potentially transformative payoffs.

Industry-Based Efficacy

Use cases demonstrate varied impacts depending on the sector:

- Retail: BI swiftly identifies sluggish products, optimizing stock and increasing sales. Data Mining helps predict demand and personalize marketing, boosting customer lifetime value over time.

- Finance: BI aids in compliance and reporting for quick risk assessment, while Data Mining detects complex fraud patterns that save millions annually.

Real-World Insights: Case Studies Highlighting ROI Velocity

Case Study 1: Coca-Cola’s BI-Driven Operational Efficiency

Coca-Cola implemented an enterprise BI platform that integrated sales, supply chain, and marketing data. Within six months, they reduced inventory costs by 15% and improved sales data accuracy.

ROI Impact: Quick, measurable savings and performance optimization, underscoring BI’s capability for rapid ROI enhancement.

Case Study 2: Capital One’s Data Mining Success in Fraud Detection

Capital One invested heavily in data mining models to detect credit card fraud by identifying anomalous transaction behavior. The models significantly reduced fraudulent transactions within the first year.

ROI Impact: Although initial setup was resource-intensive, the program saved hundreds of millions and secured customer trust, yielding a powerful long-term ROI.

Case Study 3: Zillow’s Hybrid Approach

Zillow uses BI tools for market trend analysis and Data Mining for predictive modeling of home price changes.

This synergy enables Zillow to react quickly to real estate trends (BI) while forecasting future market conditions (Data Mining), producing a balanced ROI improvement pathway.

How Businesses Can Strategically Choose Between BI and Data Mining

Assessing Your Business Maturity and Needs

- If your business needs immediate cost control and performance visibility, start with BI.

- If you aim for disruptive growth through innovation and customer behavior understanding, invest in Data Mining.

Hybrid Approach: Maximizing ROI

Many successful companies embrace a hybrid approach—starting with BI deployments to stabilize operations and layering Data Mining capabilities to unlock hidden insights over time.

Investing in Skills and Technology

Fostering a data-literate culture and hiring appropriate skills is vital. According to Gartner, by 2023, 75% of organizations deploying AI and Data Mining without skilled professionals failed to realize expected ROI.

Conclusion: Which Boosts ROI Faster?

In summary, Business Intelligence offers faster, incremental ROI by enhancing visibility and decision-making grounded in historical data. It acts as a powerful accelerator for short-term performance gains.

Meanwhile, Data Mining is an investment in the future — revealing hidden patterns and predictive insights that, although requiring more time and resources, can produce transformative ROI impacts.

Choosing between the two is not a simple either/or decision. The most effective strategy involves leveraging BI to sharpen operational efficiency immediately while building Data Mining capabilities to innovate and drive sustained growth.

Final Thought: For businesses aiming to boost ROI rapidly, prioritize Business Intelligence initiatives. However, for durable competitive advantage and explosive ROI growth, combine BI's tactical strengths with Data Mining's strategic power to harness the full prowess of your data assets.

References

- Dresner Advisory Services, "Wisdom of Crowds Business Intelligence Market Study," 2019.

- Gartner Research, "Data Science and Machine Learning Market Trends," 2023.

- McKinsey Global Institute, "The Age of Analytics: Competing in a Data-Driven World," 2016.

- Netflix Tech Blog, "Personalization Algorithms," 2020.

- Capital One Case Study on Fraud Detection, 2018.

- Coca-Cola BI Implementation Report, 2017.

Rate the Post

User Reviews

Popular Posts