Is Bitcoin Still the Best Hedge Against Inflation

19 min read Examine whether Bitcoin remains an effective hedge against inflation in 2024 compared to traditional assets. (0 Reviews)

Is Bitcoin Still the Best Hedge Against Inflation?

The world of investing is perpetually shaped by the forces of inflation. As fiat currencies erode in purchasing power, investors pursue strategies and assets that promise to preserve and even increase real wealth. Over the past decade, Bitcoin has surged to the forefront of volatility and debate, often celebrated as the modern hedge against inflation. But is that still the case in 2024?

Let’s explore what makes an effective inflation hedge, review Bitcoin’s actual performance, and consider how it compares to both traditional assets and emerging alternatives.

Understanding Inflation and the Search for Hedges

Inflation is the gradual increase in prices and the decline in the purchasing power of money. While a steady, low rate of inflation is targeted by central banks, periods of high or volatile inflation can devastate savings and fixed-income investments.

Historically, { "article": " markdown-formatted full article " ]}investors have turned to inflation hedges—assets expected to retain or even increase their value as currency buys less. Classic choices include:

- Gold: Prized for its rarity and history as money.

- Real Estate: Tangible assets like homes typically adjust in value alongside broader economic conditions.

- Commodities: Oil, wheat, and other essential goods rise in price as the cost of living does.

- Stocks: Especially companies capable of raising their prices in response to inflation.

In the 21st century, Bitcoin has emerged as a digital alternative, with proponents dubbing it “digital gold.”

Why Investors Seek Hedges

In times of currency debasement or aggressive money printing, value stored in cash can melt away. For instance, the US dollar has lost about 96% of its purchasing power in the hundred years since the US Federal Reserve was established. The desire to maintain purchasing power is what motivates investors to seek out robust hedges—and raises the critical question of which asset works best now.

Bitcoin’s Origin Story: Digital Gold or Speculative Asset?

Launched in 2009, Bitcoin was partially inspired as a response to the inflationary pressures and government bailouts during the Global Financial Crisis. The Bitcoin whitepaper painted a vision of a borderless, scarce, decentralized money. Key features highlighted by its supporters as being inflation-resistant include:

- Fixed Supply: Only 21 million bitcoins will ever be created, programmed into its code by Satoshi Nakamoto. This verifiable scarcity stands in stark contrast to fiat currencies, which central banks can and do expand at will.

- Decentralization: No single authority controls Bitcoin; it’s secured by a network of participants, making censorship or manipulation more difficult.

- Transparency: Every transaction is recorded on Bitcoin’s blockchain, making the money supply public and auditable in real time.

Bitcoin’s Hype Cycle

Bitcoin’s story as an inflation hedge gained vigor during periods of central bank stimulus—such as the COVID-19 crisis in 2020-2021, when massive amounts of new money entered the economy. Its price often surged alongside headlines about government debt and stimulus checks, attracting both retail and institutional investors searching for ways to protect their assets.

But price surges also led many to view it as a more speculative bet than a boring store of value. In practice, how did Bitcoin perform in inflationary periods?

Examining Bitcoin’s Performance During High Inflation

2021–2023: A Real-World Stress Test

Global inflation began to soar in 2021, driven by pandemic-era stimulus and supply chain bottlenecks. The US saw inflation spike above 8%, and Europe faced energy-driven price surges just as aggressively. These conditions provided a crucial live-market test for any claimed inflation hedge.

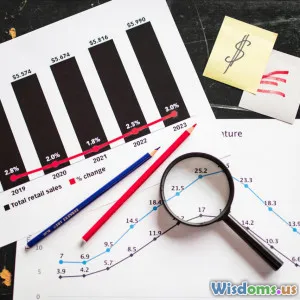

The Numbers

- 2020 Performance: Bitcoin soared from about $7,000 to nearly $29,000, a >300% return. However, much of this gain occurred before serious consumer price inflation, in the speculative lands of increased risk appetite.

- 2021: Bitcoin reached its all-time high near $69,000 in November. US CPI inflation had jumped to 6.2% by the end of the year.

- 2022: As the Federal Reserve began raising interest rates to fight inflation, risk assets—including Bitcoin—tumbled, with Bitcoin dropping as low as ~$16,000 in November.

Thus, in the teeth of rising inflation, Bitcoin did not consistently provide protection. In 2022, as inflation raged, Bitcoin’s price halved—making it a terrible short-term hedge compared to even cash, let alone gold or certain equities.

Contrasting with Gold

During the same period, gold—long regarded as the go-to inflation hedge—remained mostly flat to slightly positive in US dollar terms. Gold’s stability highlighted one of Bitcoin’s major drawbacks as a hedge: extreme price volatility driven by risk sentiment.

Institutional Adoption: Does It Change the Game?

In late 2021 and through 2022, institutional investment in Bitcoin increased, often via exchange-traded funds (ETFs) or large corporate treasuries (such as Tesla and MicroStrategy). Proponents argued that as Bitcoin became more embedded in the financial system, volatility would decrease and its hedge properties would improve. So far, the data remains mixed.

Comparing Bitcoin to Traditional and Modern Inflation Hedges

If “the best inflation hedge” is an asset that reliably maintains or increases purchasing power during inflationary shocks, how does Bitcoin measure up against the competition?

Gold: The Benchmark

Gold boasts thousands of years as a store of value, especially during crises—wars, hyperinflation, systemic banking failures. While gold can go long periods with flat returns, its track record during inflationary periods is respectable. For instance, during the 1970s (recorded as a highly inflationary era in the US), gold’s price increased dramatically, outperforming most asset classes.

Bitcoin vs. Gold: Pros & Cons

- Gold Pros: Less volatile, highly liquid, universal recognition

- Gold Cons: Physical storage, barriers of transport

- Bitcoin Pros: Scarcity, ease of global transfer, divisibility, more secure in digital form

- Bitcoin Cons: High volatility, still evolving market infrastructure, not universally accepted or trusted

Real Estate: Tangible Protection

Real estate often keeps pace with or exceeds inflation over time because property values generally rise along with building costs and consumer prices. Rental income also often adjusts upwards over time.

Limitations

Access to and management of property, lack of liquidity, and geographic risk remain obstacles. Bitcoin aspires to offer the best benefits of real estate (limited supply, decentralized ownership) while remaining liquid and global.

Commodities and Equities

- Commodities: Oil, wheat, and industrial metals often see dramatic spikes in price with inflation. However, their swings are subject to global market dynamics and may not track consumer price indices directly.

- Equities: Companies that can pass on increased costs to customers (consumer staples, energy firms) may outperform during inflation—but not all stocks benefit equally.

Bitcoin: Blend or Outlier?

Bitcoin’s role appears hybrid—it often behaves like a volatile growth asset loosely correlated with tech equities (such as NASDAQ stocks), particularly in periods of risk-on sentiment. At the same time, it’s touted as “hard money.”

But the wildly fluctuating prices in 2021–2022, and its deep slump amid tightening monetary policy, revealed that Bitcoin’s hedge value is uneven—dependent more on speculative adoption than underlying economic fundamentals.

Factors Undermining Bitcoin’s Consistency as a Hedge

Volatility

Perhaps Bitcoin’s greatest challenge as a hedge is its notorious price swings. Huge drawdowns—often 50% or more from recent peaks—make Bitcoin exceedingly risky for those hoping for steady wealth preservation. For retirees or conservative savers, such volatility can devastate purchasing power, especially if withdrawals are needed during bear markets.

Speculative Behavior and Herd Mentality

Bitcoin’s price is often driven by momentum, hype, news cycles, and speculative bubbles more than real-world inflation data. For example:

- Price surges often coincide with broad market exuberance rather than sustained inflation fears.

- Deep “crypto winters” have happened independently of fiat inflation trends.

Regulatory Risk

Regulatory crackdowns, bans, or tightening (such as US SEC lawsuits against exchanges, or China’s clampdown on mining and trading) can introduce potent downward price pressure. While no government can stop the protocol, they can dramatically impact demand, liquidity, and the broader legitimacy that maintains price stability.

Competition from Other Crypto Assets

The rapid innovation in digital assets means Bitcoin now competes with a myriad of alternative blockchains, stablecoins, and digital gold equivalents (such as Ethereum, Solana, tokenized gold, and central bank digital currencies). Each new project potentially shifts investor attention and can dilute the unique ‘hedge’ investment narrative that supported Bitcoin’s early success.

The Case For Bitcoin as a Long-Term, Non-Correlated Asset

Despite its challenges, Bitcoin retains some nuclear strengths that may bolster its role in handling inflation—especially for the globally connected and technologically savvy generation.

Limited Supply and Predictable Issuance

Unlike government fiat currencies whose supply can rise rapidly, Bitcoin’s issuance rate is pre-set. The quadrennial “halving” event—when miner payouts are slashed in half—naturally constrains new supply. Some analysts believe that over long time frames, this self-discipline will reward patient holders with commensurate price appreciation.

Global Accessibility and Censorship Resistance

Bitcoin isn’t bound to any one nation, making it attractive for those living in economies experiencing hyperinflation or capital controls (e.g., Venezuela, Nigeria, Argentina). In these nations, the ability to easily store and move wealth internationally in a borderless asset has proved uniquely valuable, especially as local currency becomes nearly worthless.

Example: In countries like Turkey (which saw lira depreciation over 50% in 2023) or Lebanon (whose banking system froze assets), everyday people turned to local Bitcoin markets and P2P exchanges simply to maintain access to value—demonstrating some real-world hedging behavior, even as locals took on significant risk.

Technology & Transparency

Bitcoin allows anyone with an internet connection to send, receive, and store value in verifiable, auditable form. Combined with its open-source nature, this allows a greater public trust in its underlying money supply if not always its price.

How To Incorporate Bitcoin as Part of a Hedging Strategy

For those who don’t believe in a black-and-white answer, a blended approach may make sense.

Best Practices for Allocating Bitcoin

- Moderate Diversification: Most financial advisors, even those supportive of crypto, recommend limiting Bitcoin to 1–5% of a total balanced portfolio—enough for potential upside without exposing yourself to unacceptable drawdowns.

- Rebalancing Periodically: Given Bitcoin’s volatility, regularly trimming gains or topping up during bear phases can smooth returns while reducing risk.

- Multi-Asset Hedging: Combine Bitcoin with traditional hedges such as gold, inflation-protected bonds (TIPS), real estate, and select equities. This reduces dependence on any single narrative.

- Long-Term Horizon: The more time you can commit to holding Bitcoin, the less likely you are to be a forced seller during a crash. Treat Bitcoin as a high-volatility, high-potential return asset rather than the primary value anchor in your portfolio.

- Beware Hype and Leverage: Resist fear of missing out (FOMO) and never invest based on hype alone; avoid leveraged bets which can amplify losses dramatically.

Dollar-Cost Averaging (DCA)

Periodic, fixed-amount purchases (weekly or monthly) tend to smooth out volatility while avoiding emotional trading decisions. Many successful long-term holders have used DCA to build and maintain small, low-stress positions in Bitcoin over years.

The Road Ahead: Bitcoin’s Prospects in a Changing Macroeconomic Landscape

The next decade will likely see more experimentation, adoption, and volatility in assets designed to protect against inflation.

Structural Shifts

- Rising Debt Burdens: High national debts and persistent fiscal deficits in countries like the US, UK, and Japan increase pressure on governments to pursue policies that may dilute currency value, strengthening the general case for inflation hedges.

- Central Bank Digital Currencies (CBDCs): Many governments are investigating or rolling out their own digital money—a tacit acknowledgment of blockchain’s relevance but one that may either spur interest in non-sovereign assets (like Bitcoin) or crowd them out, depending on implementation.

- Competing Crypto Assets: While Bitcoin remains the dominant network by market cap, its share of the overall crypto ecosystem has gradually diminished. Whether it maintains a leadership position as a hedge will depend on adoption, scalability, and regulation.

Wild Cards

- Geopolitical Events: Sanctions, wars, regime change, or major cross-border turmoil could sharply impact investor perceptions (and demand) for cross-border, ascetic alternative stores of value.

- Technological Innovation: If a quantum computing breakthrough undermines blockchain security, it could threaten all crypto assets. Likewise, advances in scalability and privacy could renew enthusiasm for next-generation digital assets.

Will Bitcoin Mature Into a True Hedge?

For now, Bitcoin is best understood as a high-risk, high-reward exposure to a new paradigm in money—not a classic or guaranteed inflation hedge. Some may see this as a reason to steer clear, while others will treat it as a calculated component in a richer mosaic of wealth-preserving assets.

Every investor must weigh their personal risk tolerance, time horizon, and confidence in the digital revolution against the proven staying power of assets like gold and real estate.

Ultimately, the quest for the perfect inflation hedge may be just that—a quest. But with prudence and diversification, Bitcoin can play a smart part in the modern investor’s toolkit as monetary environments continue to evolve.

Rate the Post

User Reviews

Popular Posts