The Rising Trend of Micro Investing Among Millennials Explained

19 min read Explore why micro investing is gaining popularity among millennials, its benefits, and platforms driving the trend. (0 Reviews)

The Rising Trend of Micro Investing Among Millennials Explained

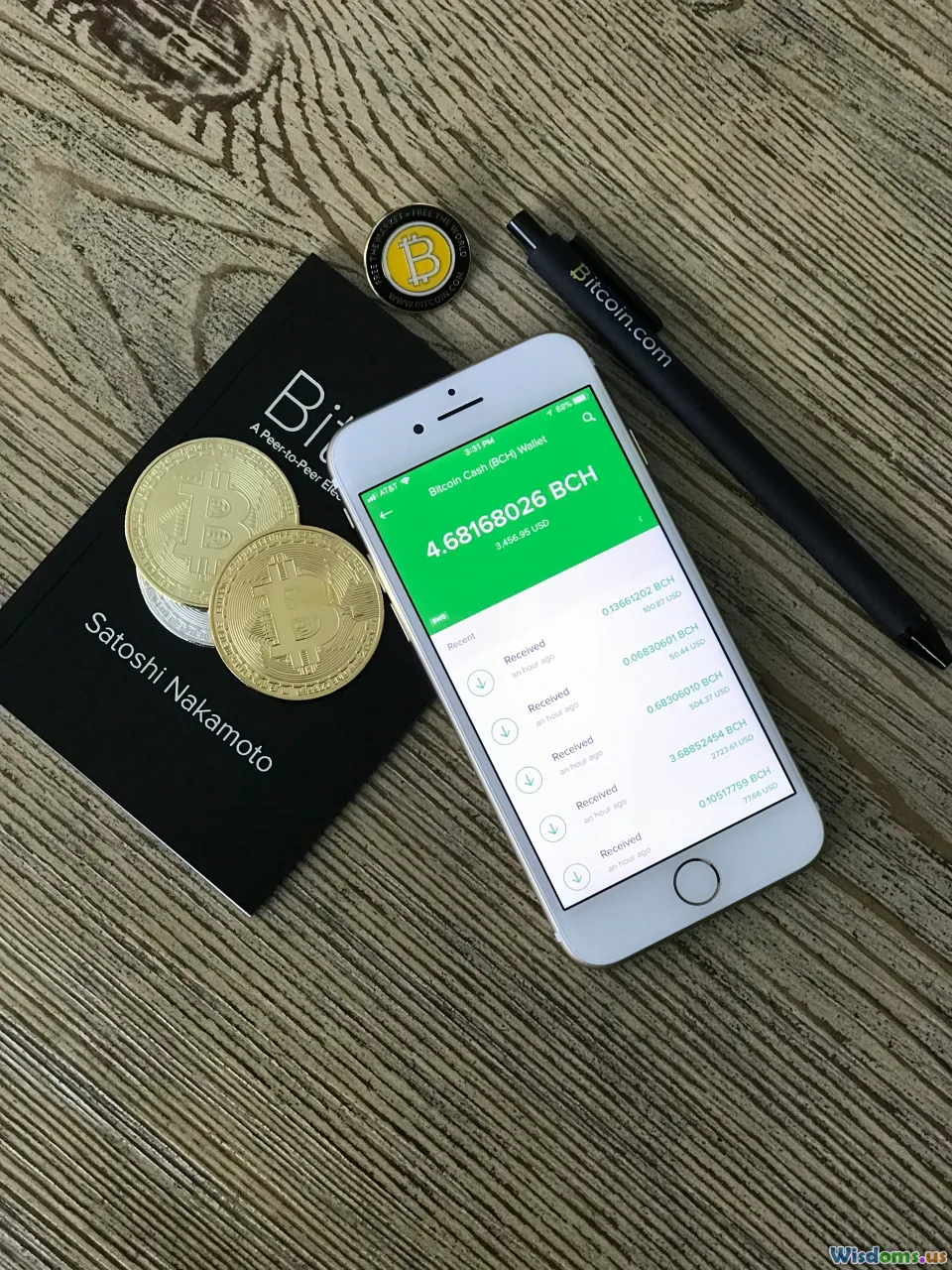

Not so long ago, the image of an investor was tied to tied ties, bustling stock floors, and intricate Wall Street jargon. Fast forward to today, and a new generation is reshaping what investing looks like: enter micro investing, a trend surging among millennials. But what's fueling this shift? From changed attitudes about money to cutting-edge technology, the landscape of personal finance is transforming right in the palm of our hands.

What Is Micro Investing? Demystifying the Concept

At its core, micro investing allows individuals to invest small amounts of money—sometimes as little as a few cents or dollars—into a variety of assets via digital platforms. Unlike traditional investing, which often requires higher minimums or brokerage accounts, micro investing seeks to democratize access to markets.

Take, for example, apps like Acorns or Stash. With Acorns, spare change from everyday purchases is automatically rounded up and invested. Buy coffee for $2.65? Acorns scoops up the leftover $0.35 and places it into a diversified portfolio. Over time, these "micro" deposits grow, harnessing the power of compound interest just like larger, institutional investments.

A 2023 Deloitte report projected that over 70% of adults aged 23-39 had tried micro investing platforms at least once, signifying vast interest and adoption. Unlike previous generations that might have considered investing an intimidating venture reserved for the wealthy, millennials are making finance more approachable—one cent at a time.

Why Millennials Are Driving the Micro Investing Boom

Millennials, loosely defined as those born between 1981 and 1996, are unique in how they manage their finances. Saddled with rising living costs, student loans, and a fast-changing job market, they began adulthood in an uncertain economic climate. For many, traditional investment methods seemed either out of reach or too risky.

Instead, millennials value:

- Low Barriers to Entry: Platforms like Robinhood or Public enable trading with no fees and, most importantly, no minimums.

- Technology Integration: Growing up alongside the internet, millennials are digital-first. Over 90% of them own smartphones, and a significant portion manage their finances through apps.

- Financial Education and Transparency: Micro investing platforms frequently include bite-sized educational content and active communities discussing market trends.

For instance, Revolut, a fintech super-app popular in Europe, lets users buy fractional shares of stocks for as little as $1. Its sleek interface appeals to digital natives accustomed to services like Spotify or Uber, marrying tech convenience with financial empowerment.

Key Platforms Powering the Micro Investing Revolution

Several fintech platforms have emerged as revolutionaries in the micro investing space. Let’s examine a few examples:

1. Acorns

Launched in 2012, Acorns popularized the roundup method. Its “Found Money” feature also rewards users with cash back when shopping with partner brands, funnelling these bonuses directly into investment portfolios. As of the end of 2023, Acorns boasted over 10 million users in the U.S. alone.

2. Robinhood

Robinhood brought commission-free trading to the mainstream. More notably, its introduction of fractional shares—allowing investors to buy slices of big-ticket stocks like Amazon or Google with just a few dollars—completely changed accessibility.

3. Stash

Stash focuses heavily on education and empowerment. Users receive personalized guidance as they build portfolios, along with easy-to-digest tutorials on investing concepts.

4. Public

This app combines micro investing with the feel of a social network. Public users share portfolios and trading updates with friends, creating a sense of community and transparency rarely found in traditional finance.

Concrete experiences from users, such as 28-year-old user Maria Duarte who began micro investing with just $20 using Stash, illustrate real-world success: “I turned my interest in social media into buying fractional shares of my favorite brands. A few years later, I had a small but growing investment nest egg I never thought possible.”

Breaking Down the Barriers: How-To Start Micro Investing

Starting is simpler than ever—all that’s needed is a smartphone and a willingness to try. Here are actionable steps to guide aspiring micro investors:

Step 1: Choose the Right Platform

Browse options like Acorns, Stash, or Public. Look at fees, available investments, and educational resources. Most apps are free to download, but always read the fine print on subscription or transaction fees.

Step 2: Link Your Funding Source

Most platforms require linking a checking or savings account, debit card, or credit card. This allows for easy transfers and round-ups. Security should be a top priority (look for apps with two-factor authentication and FDIC-insured accounts).

Step 3: Set Your Investment Preferences

Decide if you want to invest spare change, schedule recurring deposits, or make one-time investments. New investors often benefit from automation—"set it and forget it." Acorns, for example, lets users set daily, weekly, or monthly contributions.

Step 4: Build Your Portfolio

Most apps offer pre-made portfolios based on factors like risk tolerance and investment goals. These typically include a mix of stocks, bonds, and ETFs (exchange-traded funds).

Step 5: Track and Adjust

Review your investments periodically. Micro investing isn’t about making a quick buck. Instead, it’s about consistency and learning over time.

A concrete plan like this helps novice investors overcome inertia and build healthy financial habits, a critical step in long-term wealth creation.

Micro Investing vs. Traditional Investing: A Closer Look

Micro Investing Traditional Investing

| Aspect | Micro Investing | Traditional Investing |

|---|---|---|

| Minimum Investment | $1 or less | $500, $1000 or more |

| Fees | Often low or none | Can be higher (brokerage, advisor fees) |

| Ease of Use | Mobile-first, intuitive | May require advisors or manual trading |

| Learning Curve | Lower: educational features in-app | Higher: more research needed |

| Customization | Pre-built portfolios, fractional shares | Highly customizable for experienced investors |

| Audience | Beginners, young investors | Seasoned or higher-net-worth individuals |

While micro investing can be a springboard, traditional investing offers advanced strategies (retirement planning, tax optimization, etc.) that may become essential as assets grow. Seasoned investors often blend both worlds, starting small and gradually incorporating more sophisticated products and advice.

The Psychology Behind Micro Investing’s Popularity

Behavioral finance has long noted that humans struggle with delayed gratification. Micro investing tackles this by making saving and investing rewarding, instantaneous, and virtually painless.

1. Gamification and Behavioral Nudges

Apps like Acorns and Stash employ micro incentives—streaks, badges, and visual progress bars. These turn mundane acts of saving into a game-like experience. Over time, these positive reinforcements foster long-term habits.

2. Emphasizing Progress Over Perfection

For millennials coping with economic volatility and rising costs, starting with small amounts provides psychological comfort. Rather than waiting to accumulate large sums, they are empowered to "do something" now. Research from Bankrate shows that 64% of millennials began micro investing specifically because of its low stress and approachable entry points.

3. Social Proof and Community

Public and similar platforms include features reminiscent of Instagram or Facebook. Users share investment wins, exchange advice, or celebrate milestones, blending financial growth with social connectivity.

Example: A Reddit thread in r/personalfinance illustrates this well. One user posted: "Did my first $10 investment on my phone at work today—felt better than buying lunch! Who else started this way?" The flood of responses indicates a collective movement.

The Role of Fractional Shares and ETFs

A major leap in democratization comes from the availability of fractional shares and Exchange-Traded Funds (ETFs).

Fractional Shares

In the past, to own a single share of a high-value company like Tesla (whose stock had peaked at over $1,000 per share in 2021), an investor needed to shell out that full amount. Now, micro investing allows someone to buy, say, $5 worth of Tesla. This spins asset ownership on its head, making iconic brands accessible to all.

Exchange-Traded Funds (ETFs)

Many platforms auto-invest spare change or recurring contributions into diversified ETFs. For example, the Vanguard Total Stock Market ETF (VTI) comprises hundreds of different companies, so users could conceivably own a piece of Apple, Microsoft, and Coca-Cola—simultaneously—for the price of their morning coffee.

Data shows that over 60% of all micro-invested dollars in 2023 went into broad-market ETFs, emphasizing millennials’ preference for diversified, lower-risk holding patterns over high-concentration bets.

Potential Risks and Considerations

While micro investing opens doors, it’s not risk-free—in fact, some unique pitfalls lurk beneath its simplicity.

- Overlooking Fees: Some micro investing apps charge recurring monthly fees (even if small, like $1). For tiny portfolios, these fees can outpace investment returns. For instance, a $1 monthly fee on a $50 portfolio equates to a hefty 2.4% annual drain just from servicing alone.

- Limited Customization: Beginners may unknowingly park funds in portfolios whose objectives (e.g., aggressive growth, conservative bonds) don't match their risk profile. Learning about asset allocation is key.

- Market Volatility: As always, even diversified ETFs fluctuate. Micro investing simplifies the journey, but not the risks. History shows that even broad indexes can experience downturns, such as the 20% market dip at the start of the COVID-19 pandemic in 2020.

- Lack of Holistic Planning: Micro investing is often a stepping stone, not a comprehensive strategy. Retirement, taxes, and estate planning require additional tools and expertise.

Advice: Always review fee structures, know your risk tolerance, and use micro investing as a complement—not a replacement—for robust personal finance planning. Many platforms offer free educational resources and calculators to aid understanding.

Case Studies: Real Millennials, Real Impact

Let’s hear from millennials who turned skepticism into opportunity:

- Ashley (29, Austin, TX): Ashley utilized Acorns to passively invest spare change from coffee runs and online shopping. "At first it seemed trivial, but in two years I’d stashed over $1,200. It was painless, like planting seeds that grew quietly while I went about my life."

- Brian (33, Boston, MA): Brian began with Stash’s $5 minimum investment, learning from its in-app lessons. Gradually, he increased contributions, eventually branching into direct brokerage accounts for more advanced planning.

- Samantha (27, San Francisco, CA): Through Public, Samantha built up a mini-portfolio of companies she admired. The ability to discuss moves and share insights with friends kept her accountable and engaged.

These experiences echo a broader truth: micro investing empowers and educates, especially when tailored to real-world lifestyles and ambitions.

Forecasting the Future: Will Micro Investing Shape the Next Decade?

The impact of micro investing is already visible across continents. In Asia, platforms like Raiz (Australia and Indonesia) and Chime (U.K. and U.S.) are expanding in popularity. Europe’s fintech scene, with players such as Revolut and Trade Republic, is popularizing similar services.

Looking ahead, several trends will likely keep momentum high:

- Continued Digital Integration: Advancement in open banking and AI-powered personalization will further streamline investing experiences.

- Expansion Into New Asset Classes: Expect micro investing to venture into alternative assets—such as real estate, cryptocurrencies, or art—offering millennials unexplored ways to diversify.

- Greater Emphasis on ESG: Environmental, Social, and Governance (ESG) investing is important to younger investors. Apps are now adding "sustainable" or "impact" portfolio options.

- Financial Inclusion: As smartphone penetration deepens globally, what began as a Western trend is now unlocking markets in Africa, Latin America, and Southeast Asia, bridging the global wealth gap bit by bit.

Morgan Stanley projects the global micro investing market will reach $120 billion in assets managed by 2027—a tenfold increase from 2020.

Practical Tips for Millennial Micro Investors

Anyone can begin micro investing, but smart, intentional habits render the best results. Here are a few essentials:

- Start Early, Stay Consistent: Compound growth favors time in the market. Small but regular contributions outperform occasional big deposits.

- Trust Diversification: Don’t put all funds into a single stock or sector; ETFs or diversified portfolios are safer.

- Embrace Education: Take advantage of embedded tutorials and community forums.

- Review Goals Periodically: As incomes rise or circumstances change, recalibrate investment strategies.

- Beware of Overtrading: Some platforms make buying and selling frictionless. Resist compulsive trades spurred by news noise.

An example: If you invested just $5 a week from age 25, at an average annual return of 7%, by age 65 you could accumulate over $55,000—demonstrating the outsized power of tiny, regular investments.

For millennials everywhere, micro investing is more than a trend—it’s an entry point into financial independence, powered by technology, transparency, and collective ambition. As these platforms continue to blend learning, ease, and community, the future of investing will truly be shaped by the digital fingertips of a generation determined to own its financial story.

Rate the Post

User Reviews

Popular Posts