Renewable Energy Scams Exposed What Investors Should Know

16 min read Uncover common renewable energy scams and essential tips every investor should know to protect their money and make informed decisions. (0 Reviews)

Renewable Energy Scams Exposed: What Investors Should Know

Renewable energy stands as one of humanity's most vital tools in combating climate change. With governments, corporations, and individuals gradually pivoting towards solar panels, wind farms, hydrogen cells, and other green technologies, it's no surprise that investment in this sector has soared. According to BloombergNEF, global investment in the energy transition reached a record $1.3 trillion in 2022, projected to grow in the coming years. However, the high demand and rapid innovation have also created an opportune landscape for scams targeting eager investors.

Below, we uncover how renewable energy scams work, how to identify them, and how genuine investment opportunities differ from fraudulent schemes. If you're considering putting money into the green economy, these actionable insights can safeguard both your savings and the planet.

How Renewable Energy Scams Operate

The renewable energy sector's rapid evolution and the promise of lucrative returns make it a magnet not only for honest innovation but also for fraudsters. Scammers often use classic tactics, updated for the times, to lure in even the savviest investors.

The Anatomy of a Typical Scam

Most green energy scams follow a similar playbook:

- False Technologies: Fraudsters promise revolutionary advancements––such as solar panels with 500% more efficiency or perpetual motion wind turbines––that defy the limits of current science and engineering. Many websites have marketed non-existent or unproven technology to create hype.

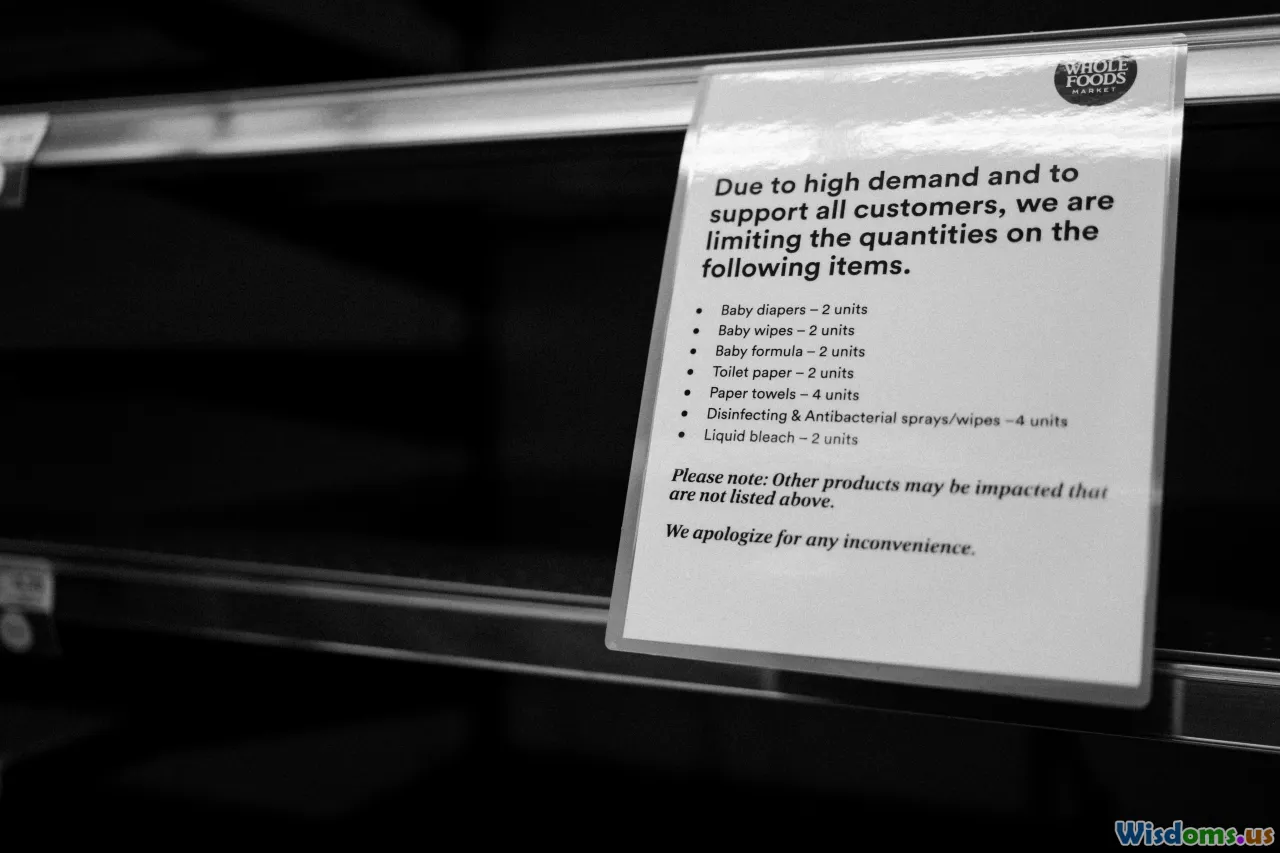

- Guaranteed High Returns: Like classic Ponzi and pyramid schemes, scam operators dangle the carrot of guaranteed, high-yield returns, far above market averages. Energy production is subject to fluctuating costs, regulatory changes, and physical factors, making ironclad guarantees highly suspicious.

- Pressure Tactics: Scammers typically rush prospects into acting quickly ('limited slots,' 'last chance to get in on the ground floor,' etc.) to short-circuit rational decision-making.

- Impersonation and Fake Partnerships: Fraudsters often claim associations with respected companies or government bodies, bolstering their credibility. In recent years, forged partnership announcements with Tesla or Siemens have appeared in multiple scam pitches.

Recent Examples Across the Globe

- UK Solar Investment Scheme (2018): More than 800 investors lost approximately £13 million in a coordinated solar panel scam, where the company faked installation contracts and misrepresented performance data.

- Wind Turbine Ponzi Scheme (US, 2019): The founder of DC Solar Solutions was convicted after orchestrating a $1 billion Ponzi scheme involving fake mobile solar generators, using investor funds to pay previous investors and finance a lavish lifestyle.

These cases emphasize how real-looking operations can mask high-stakes deceptions, even in seemingly transparent markets.

Telltale Signs of Renewable Energy Investment Scams

Fortunately, most scams reveal their deceptive nature to those who know what to look for.

-

Unrealistic Returns: Be skeptical of returns promising double-digit gains in short periods. A legitimate renewable project (e.g., a solar farm) might provide 5-8% annual returns, considering installation costs, maintenance, and regulation. Anything exceeding this by leaps and bounds deserves scrutiny.

-

Opaque Business Structures: If ownership, leadership, or business addresses are hard to verify, take it as a red flag. Scammers frequently funnel investments through opaque offshore entities or secondary shell companies, making regulatory recourse nearly impossible.

-

Poorly Written Contracts or Lack of Documentation: Legitimate companies will always provide detailed, clear contracts outlining risks and potential returns. Scammers, if they provide documentation at all, often issue vague, typo-riddled documents lacking legal safeguards for the investor.

-

Aggressive Cold Calling and Email Campaigns: Authentic industry players rarely employ unsolicited, high-pressure sales tactics. Financial authorities in North America and Europe have issued repeated advisories about scams launched via social media, spam emails, or phone campaigns.

-

Lack of Independent Oversight: Any credible public investment will reference independent engineering reports ("bankable feasibility studies") or show audit trails. If due diligence data is absent or not available for review, dig deeper before parting with your capital.

Case Studies: Dissecting Renewable Energy Scams

Case Study 1: Green Energy Commodities’ Misleading Offerings

Between 2016 and 2018, Green Energy Commodities, a UK-based solar energy promoter, offered shares in solar farms, promising sky-high returns. They forged documents to simulate real solar farm earnings and harnessed the climate investment trend to net millions before investigations led to prosecutions. Authorities found incomplete planning permissions and fake certifications underpinning their business.

Key Lessons: Always seek third-party verification of claims and cross-check told figures with public company registries or government renewable certificates.

Case Study 2: Hydrogen Fuel Investment Promises

Hydrogen power is one of clean energy’s buzziest technologies. In 2021, multiple companies in Asia and the US began drawing in investors with promises of "groundbreaking hydrogen catalysts." The US Securities and Exchange Commission halted several offerings, where sales pitches far outpaced the companies’ R&D realities.

Key Lessons: Research whether a company’s technology matches existing scientific consensus, and beware of "secret breakthroughs" kept hidden from peer review or reputable demonstration.

Case Study 3: Crypto-Backed Renewable Energy Scams

The "ecoin" boom saw several startups marketing new cryptocurrencies supposedly backed by real-world wind, solar, or tidal projects. Many such tokens disappeared overnight, leaving investors holding worthless digital coins. In 2023, Europol traced the losses from one major case to over €30 million.

Key Lessons: Cryptocurrency investments should never replace traditional due diligence. Verify underlying assets, governance, and actual links to renewable energy assets.

Distinguishing Genuine from Fraudulent Opportunities

There are many legitimate ways to invest in renewable energy—so how can investors separate the wheat from the chaff?

Hallmarks of Real Green Investments

- Founded Partnerships and Public Track Records: Genuine operators readily share their partners, be it utility conglomerates, regulators, or engineering firms. These relationships are publicly verifiable through press releases, news items, or filings.

- Licenses and Regulatory Disclosure: Trustworthy operations hold the necessary licenses (such as SEC-approved status in the US or FCA regulation in the UK). Project sites, permits, and planning permissions can be verified with public authorities.

- Third-Party Audits: Real projects regularly undergo audits from reputable firms (e.g., KPMG, PwC, Bureau Veritas) and issues of project completion, financing, or performance are documented in public records.

- Transparent Communication: Investor communications from reputable firms are balanced, acknowledging risks and setting realistic expectations rather than over-promising siren-call returns.

Methods for Your Due Diligence Toolbox

1. Search Official Databases: Always look for company registration on official government registries. In the US, check the Securities and Exchange Commission’s (SEC) EDGAR system; in the UK, use Companies House. For larger renewable installations, local authorities maintain records of permits and licenses.

2. Request and Review Independent Reports: Before investing, ask for not just business plans, but independent feasibility studies, engineering assessments, and financial audits.

3. Verify On-the-Ground Assets: Whenever possible, visit the site or hire an independent local auditor to confirm the existence of facilities and their status.

4. Review Media and Industry Mentions: Look for coverage beyond company press releases. Has the project or firm been featured in reputable energy trade outlets? Is there coverage of management's track record?

5. Understand the Team: Check executives’ and founders’ histories for prior successful (or failed) projects. LinkedIn profiles and references in professional publications can be revealing.

Regulatory Protections: How the System Can Help (and Where It Can't)

Global regulatory agencies have taken concerted steps to reduce criminal activity in the burgeoning renewable sector, but regulations are only as effective as their enforcement and the awareness of investors themselves.

-

Securities Regulation and Enforcement: In the US, the SEC has ramped up renewable investment scrutiny. The UK's Financial Conduct Authority regularly publishes scam warnings. Meanwhile, every member of the European Union has regulatory requirements for public securities offerings, green bonds, and crowdfunding.

-

National and Regional Registries: Most countries maintain renewable plant registries, viewable online. In Australia, for instance, the Clean Energy Regulator lists accredited renewable generators and their output. German authorities require all funded, operating green plants to be entered in the Marktstammdatenregister.

-

Consumer Advocacy and Awareness: Organizations like the Better Business Bureau, Europol, and Interpol often release scam alerts detailing current tactics and trends in renewable energy fraud.

Yet, for every regulatory safeguard, scammers attempt to work around the system. Many target international targets via offshore entities, or pose as representatives of legitimate companies, making them harder to prosecute.

Actionable Investor Tips to Outsmart the Fraudsters

To protect yourself and your money in the fast-evolving world of renewable energy, practice the following due diligence:

1. Dig Deeper Before You Commit: Ask direct, challenging questions about technology, business models, and partners. Set aside emotion and demand reasonable evidence at each step.

2. Don’t Be Rushed: If someone is pressing you with artificial urgency, remember: Real investments will still be there tomorrow. Take the time to read documents, check facts, and consult experts.

3. Research Complaints: Look up reviews across consumer report websites. Check for unresolved regulatory complaints, negative news stories, or listed warnings related to the company or principals involved.

4. Cross-Verify with Regulators: Contact securities regulators to verify if the company and offering are registered and complaint-free.

5. Consult Industry Professionals: Even a brief paid consult with an independent renewable energy engineer or financier can save you from catastrophic loss. They'll quickly spot implausible numbers or missing information.

6. Be Skeptical of Friends or Social Media Referrals: Many scams thrive by recruiting early investors—sometimes unwittingly—to draw in friends and family. Verify every referral, no matter the source.

Avoiding Regret: Smart Pathways to Green Investing

Investing in the renewable energy revolution has never been more important — or more popular. The planet desperately needs capital and innovation to decarbonize its energy mix; but capital should always flow smartly and safely. When you’re considering green investment opportunities, let prudence be your guiding light.

Choose regulated funds, established platforms, or publicly traded companies with diverse portfolios and long-term plans, especially when starting out. If your goal is to fund a truly early-stage project or a peer-to-peer energy startup, insist on transparency, external verification, and the right to walk away if ever in doubt.

The good actors in the renewable energy ecosystem are committed to changing the world — not just hyping a story. With patience, a passion for detail, and a healthy dose of skepticism, every investor can help steer the green revolution toward a genuinely brighter future.

Rate the Post

User Reviews

Popular Posts